Fed Chair Powell Says Continued Pressure to Be Placed to Abate Inflation

The Federal Reserve in its November FOMC meeting again opted to raise rates a quarter point again in an assertive attempt to bring down inflation.

Inflation is down only a tenth percent in the latest readings, at 8.2 percent from an annual high of 9.1 in June. Most economists agree that inflation has become entrenched throughout, affecting businesses and households alike.

It’s clear that fuel and energy costs have had a massive impact across the economy, from shipping and airlines to households and Main Street commerce.

The Fed repeatedly has stated the goal is to press inflation back to 2 percent with as little pain as possible.

“Despite the slowdown in growth, the labor market remains extremely tight, with the unemployment rate at a 50-year low, job vacancies still very high, and wage growth elevated,” Powell said. “Job gains have been robust, with employment rising by an average of 289,000 jobs per month over August and September.

Powell acknowledged job vacancies have moved below their highs and the pace of job gains has slowed from earlier in the year, indicating the labor market continues to be out of balance with demand and is substantially exceeding the supply of available workers.

Nick Timiraos of the Wall Street Journal asked about the prospect of having to move rates, now at 3.75 to 4 percent, above the level of inflation to make the needed downward pressure in the economy.

“I think you put some weight on that, you also put some weight on rates across the curve. Very few people borrow at the short end, at the federal funds rate for example, so households and businesses, if they’re very meaningfully positive interest rates all across the curve for them, credit spreads are larger so borrowing rates are significantly higher and I think financial conditions have tightened quite a bit,” Powell said. “So, I would look at that as an important feature. I’d put some weight on it but I wouldn’t say it’s something that is the single dominant thing to look at.”

S&P CoreLogic Home Price Index Continues to Decelerate

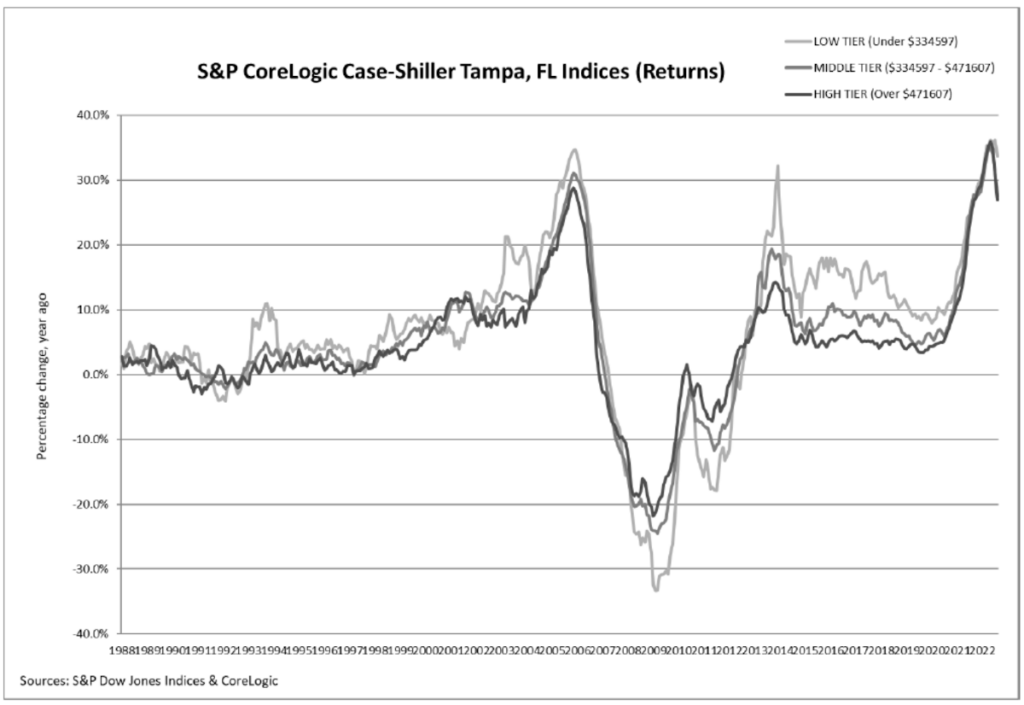

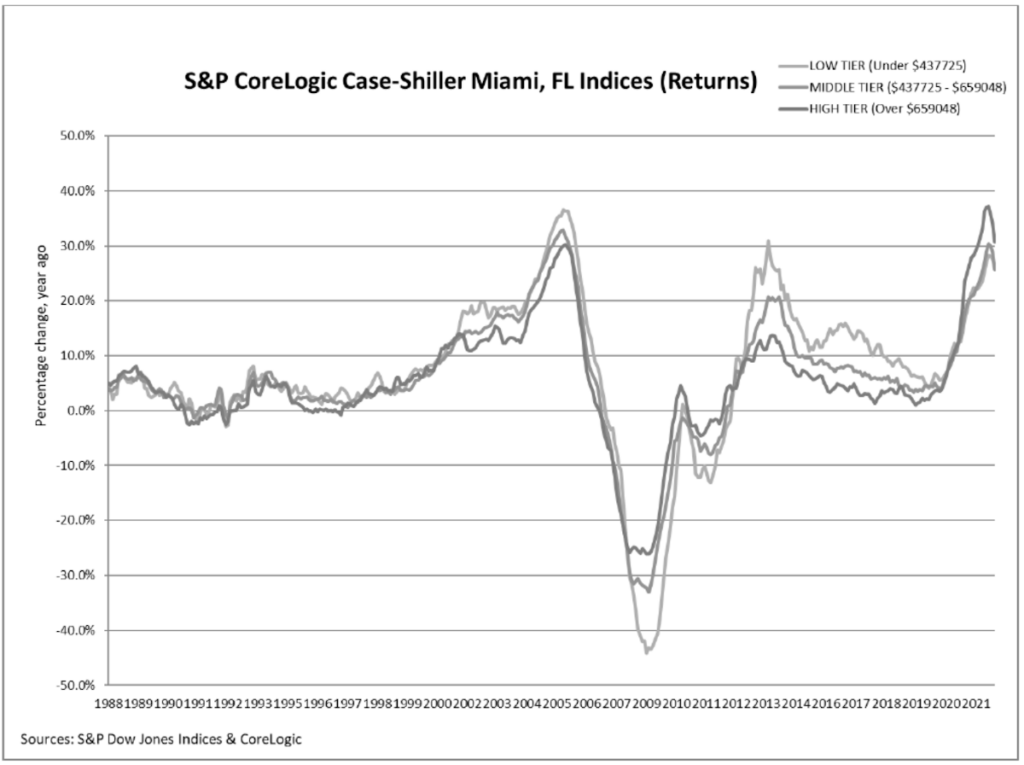

The latest S&P CoreLogic Case-Shiller Indices for August 2022 show continued deceleration in home values across the U.S.

The CoreLogic Case-Shiller index is the leading measure of U.S. home prices.

National home prices in nine U.S. census divisions reported a 13 percent annual gain in August, down from 15.6 in July.

The 10-City Composite annual increase came in at 12.1 percent, down from 14.9 in the previous month. The 20-City Composite posted a 13.1 percent year-over-year gain, down from 16 percent in the previous month.

Miami, Tampa, and Charlotte reported the highest year-over-year gains among the 20 cities in August. Miami led the way with a 28.6 percent year-over-year price increase, followed by Tampa in second with a 28.0 percent increase, and Charlotte in third with a 21.3 percent increase.

All 20 cities reported lower price increases in the year ending August 2022 versus the year ending July 2022.

MHInsider is the leader in manufactured housing news and is a product of MHVillage, the top marketplace for manufactured and mobile homes.