Founders of Cascade Financial Look to Expand Market Share in Growing Sector of Housing

Cody Pearce and George Dover met in September 1997.

Both men were being hired to work for a small mortgage lender in Utah, with Cody moving to Boise, Idaho, start a retail branch for the company, George joining as the vice president of operations at the home offices.

The tandem spent the next two years working in close contact with George serving as a mentor to Cody, who was newer to the mortgage business.

“Over time it became apparent to both of us that with George’s operational expertise and my experience in production and sales that there was an alliance at hand that could work really well,” Pearce said.

Dover and Pearce agreed they should pursue a business partnership. It was only the two years later that the pair exited their respective roles in Utah and moved to Phoenix to launch an altogether new endeavor.

Little did they know what an endeavor it would be.

The Move to the Desert

Dover and Pearce packed up what little they had, shared a U-Haul and moved their small families to Gilbert, Ariz., to found Cascade Financial Services.

“Everyone finds it humorous that we rented a house together for the first four months while we started the company,” Pearce said. “I suppose looking back it was unusual, but to us it just made sense. We were broke, living in a new state and we knew George and I would be working around the clock.

“So it made perfect sense to share expenses and make the strain for the hours worked easier on our families,” he said.

Although the two were friends, they had spent no time in close quarters. With the move to Arizona, it quickly became apparent just how different they were from each other, and how that could serve to their advantage.

“One of the first days in the rental house Cody started loading the dishwasher after dinner,” Dover said. “It wasn’t organized at all and it was obvious that he was never going to fit everything into the dishwasher.

“I just couldn’t take anymore so I stood up and I told him to step away, at which point I finished the job for him,” he added.

Pearce responded with a laugh, and recalls the look on his business partner’s face.

“He told me in no uncertain terms to never load the dishwasher again,” Pearce recounts. “I knew then and there that we could orchestrate the ideal partnership, for our business and for the people we serve.”

The Hot Housing Market

Arizona at the end of the last millenia, was a booming market in the housing industry. Conditions had fostered a significant amount of entrenched competition. It also was a time of rising interest rates, and the combination of that and a high level of competition created a difficult environment to get a foothold in the mortgage lending arena.

“As we worked on lead generation methods, we came to the realization that starting Cascade was proving to be much more of a challenge than anticipated,” Dover said. “Fortunately, as reality was setting in, we crossed paths with an industry contact who mentioned a new loan product that was gaining traction in many of the Sun Belt states.”

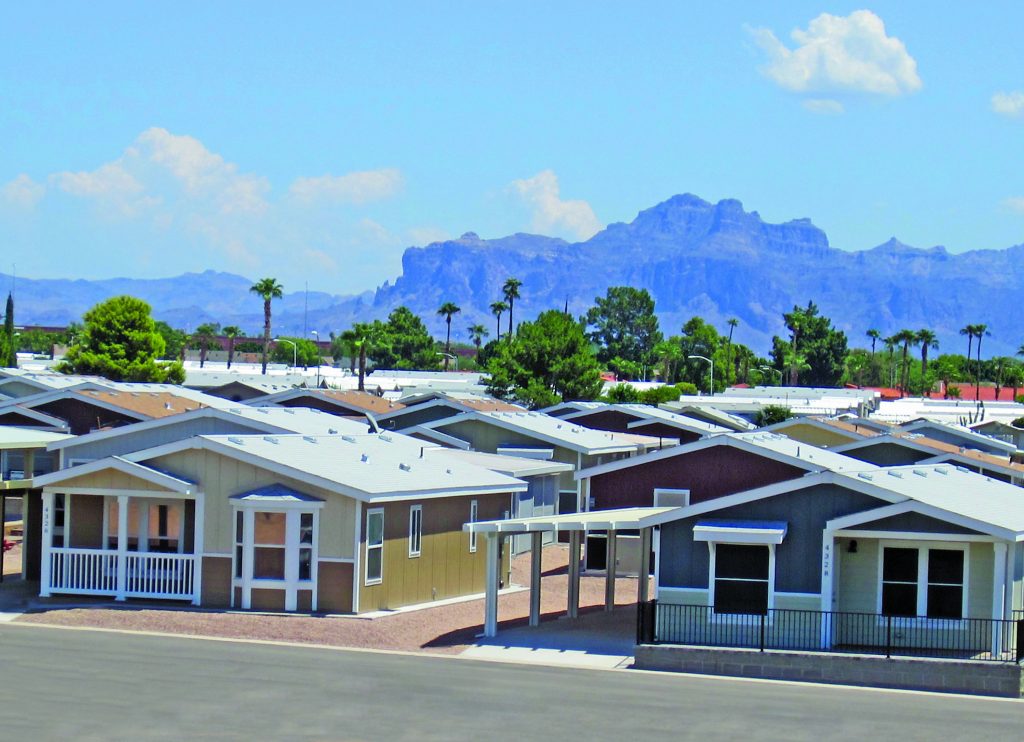

The product, which was a foreign concept to Dover and Pearce at the time, was a construction to perm loan for new manufactured homes being placed on real estate.

Pearce and Dover played with the idea, and kept an open mind about the new concept.

“Our initial research was very encouraging when we discovered that, at the time, there were well over 20 manufactured home retailers on Apache Trail in Mesa and Apache Junction,” Pearce said. “Wanting to understand the market and the demand for this product, we spent an August afternoon out on ‘The Trail’ speaking with retailers to gain perspective on the demand as well as to assess current lending competition in the market.”

Knocking on Doors

After visiting three or four retailers, the Cascade tandem changed the conversation.

“We had been asking asking retailers what they needed, and pretty quickly we were entering with a conversation about ‘what we can do for you’,” Pearce said. “Even though we really still had no idea how the product worked, just hearing the demand and desperation that existed for manufactured home loan products in 1999 had a big impact on us.”

While lenders were having liquidity issues, Pearce and Dover realized that they had just stumbled onto something big. They just had no idea at the time just how big.

Dover put his expertise to work. He occupied himself during the next several days dissecting and analyzing the loan product and creating processes needed to offer the product. Pearce continued to establish relationships with the retailers, and he began taking loan applications.

It was more than a new product. It was a new business, and the start of a new era in lending.

The Birth of Cascade as an MH Lender

While that original form of the construction to perm product was relatively short lived, Cascade had primed itself for a new mission. The mantra of “Servicing the American Dream Through Affordable Home Ownership” resonated with Pearce and Dover, and to fully embrace the concept Cascade Financial transitioned its lending platform to nationwide FHA and VA construction to perm loans for manufactured housing.

“Our mission statement is more than a slogan, it’s who we are,” Dover said. “It’s what our team members focus on, and we are fortunate to be able to work in such an incredible industry serving deserving consumers.”

Ryan Stum, Wayne Bond and George’s brother Gerron Dover joined the Cascade team in 2003. The added talent and leadership served as Cascade’s initial foray beyond the Arizona state line. Bond took over as CFO, alleviating George Dover of many of his primary responsibilities.

“That way George could work on continually improving processes,” Pearce said. “Ryan and Gerron moved to Texas and opened up that market for Cascade, which was a tremendous catalyst for growth. The three later they became equity partners and have been integral to the overall success of Cascade Financial.”

Carving a Path for Manufactured Home Lending

However, there were challenges.

The group’s ability to find what are called “take-out lenders” — large financial conglomerates that could assume a loan or loan portfolio — proved to be a constant issue in those early years.

Many of these lenders to whom Cascade sold their loans had eliminated manufactured housing from their offerings. This forced Cascade to continually look for liquidity, which became burdensome when what they wanted to be doing was originating loans for manufactured housing.

“It became apparent that we had to take control of our future. We need to have it in our own hands,” Dover said. “And the best way to do that was to become a Ginnie Mae issuer.”

Enter Ginnie Mae and Untold Market Forces

It was 2007, and Cascade had just received its Ginnie issuer number. And just as quickly, the doorstep of the Great Recession appeared.

As lenders folded up or exited the MH market, Cascade went ahead with the plan to expand its footprint for manufactured home buyers.

It may have been counterintuitive, but for Cascade it worked.

“I was answering calls it seemed daily from a salesmen or a general manager of a retail business in some other state,” Pearce said. “They had heard good things from their friends in the industry and wanted to know when we were going to get licensed in their state. The demand for our loan products was there and we realized the incredible opportunity that lay ahead of us if we were to choose to accept it.

“For us, there was only one way forward. Growth,” he said.

Pearce said the challenge in any expansion effort is the need for service levels to remain a point of pride. Retailers and borrowers had built an expectation of what they would get from Cascade. The team in Gilbert, Ariz. always had been relationship focused. As a lender, Cascade built a “high-touch organization”. Industry partners expected Pearce and Dover to be accessible, and to maintain the small company feel even if they were to grow.

“This wasn’t and isn’t easy to do, and we certainly have had our share of growing pains, but we never forget how we got here and that our retailers and community partners are the reason,” Pearce said. “So, we are continually working on improving our service level, speed and efficiencies so that manufacturers, retailers and communities can continue to provide much needed affordable housing opportunities to consumers.”

Cascade’s In-House Service Platform

Along with the Ginnie approval came the need to create an in house servicing platform. So, of course, Dover built Cascade’s from scratch. He knew that creating a high-touch servicing department for borrowers would be critical to their success in maintaining payments and staying in homes.

“Our goal is to work for every opportunity for our clients,” Dover said. “Other traditional servicers just weren’t providing this type of high-touch effort, and we felt a responsibility to give our borrowers something better.”

Loan servicing became the game-changer Cascade and the industry needed. Immediately, the quality and performance of Cascade portfolios began to improve.

A High-Touch Approach to Customer Service

“The current servicing leadership team and their group of professionals, in my opinion, is second to none in the lending industry,” Pearce said. “We are confident that our borrowers have the best servicing experience possible.”

A good example of this is Cascade’s FHA “compare ratio”, which puts their current government loan performance up against all other FHA loans, including mortgages for site-built homes. Cascade has a 78 percent compare ratio, which means their FHA loans default at 78 percent of the national average.

“This shows that manufactured home borrowers perform on par, and, in our case, better than other collateral types when serviced correctly,” Dover said.

The two, early in their careers, decided to work as closely as possible with regulators and elected officials. This would ensure the longevity of manufactured home financing, which is a clear benefit for Cascade. But these types of assertions — working closely with regulators and elected officials — can be more easily said than done.

How Cascade Financial Gradually Became a National Resource

Dover and Pearce recall the early 2000s at a meeting for the Mortgage Bankers Association in Washington, D.C. There was an “introduce yourself” type of question going around the room.

“George was responding to the question, and every head in the room seemed to spin for a closer look at the dumb guys who only financed manufactured homes,” Pearce said. “They couldn’t believe that an entity would do that with all of the subprime loans and home equity lines that were being offered at the time.”

George said he felt their industry colleagues at the time were unable to give Cascade any real credit as “real mortgage lenders”. Years later during the mortgage crisis, after the subprime and equity markets turned and spiraled, their peers saw Cascade’s growth while many entities in the room that day long ago were no longer in business.

“They went from kind of laughing at us, to taking us very seriously,” Pearce said.

When D.C. Comes Calling

Eventually, the Mortgage Bankers Association became a great ally and resource to Cascade. It has supported MH-positive consumer lending rules and regulations and been instrumental in placing Cascade in front of regulators and elected officials.

“We get to tell our story and to shine a light on the tremendous need for affordable housing finance in America,” Pearce said.

Shortly following Cascade’s advanced involvement with MBA , Pearce engaged in a similar way with the Manufactured Housing Institute, the nation’s lone industry trade organization, which he said has been a positive step for Cascade and the industry.

“MHI is the link for lenders and all aspects of our industry to work together to create positive outcomes for our consumers. With no secondary market for chattel financing, Cascade has worked closely with its peers to educate regulators, Congress, HUD and the GSEs,” Pearce said.

“Cody has really helped our industry tremendously in bringing his mortgage background and lending experience to manufactured housing,” Kevin Clayton, CEO of Clayton Homes, said during a presentation at the manufactured housing conference in Arizona. “His work in Washington and with individual customers nationwide is making a difference.”

Cascade’s Centerbridge Partnership

Centerbridge Partners, a private equity firm with a robust understanding and background in manufactured housing, approached Cascade in 2015 with the idea of providing capital to expand Cascade’s current lending platform to include chattel and non-government loans.

The timing, once again, seemed fortuitous.

In August 2016, Centerbridge acquired Cascade and the lender immediately built chattel finance options for retailers and manufactured housing communities across the country. By the end of 2018, Cascade will be licensed in all 50 states for originating and servicing their entire offering of loan products.

With nationwide shipments on the rise, MH becoming more and more mainstream as a viable option for much needed affordable housing in the U.S., and with the encouraging push into MH financing by government-backed corporations, Cascade’s outlook continues to be as bright as the desert sun.

“We have done a lot to get here, we are proud of that, but we have so much more than we need to accomplish,” Pearce said. “With a great partner in Centerbridge our path forward is clear.

“Over the years, despite ups and downs, we have not had to reduce the size of our team due to lack of volume,” he said. “This is something we are very proud of, and our team members know that we are going to do everything possible to continue this pattern. We are loyal to our team and they are loyal to our customers. This is why we continue to set the pace for service in the industry.”