Rate Hikes to Continue Through ’22 to Ease Inflation

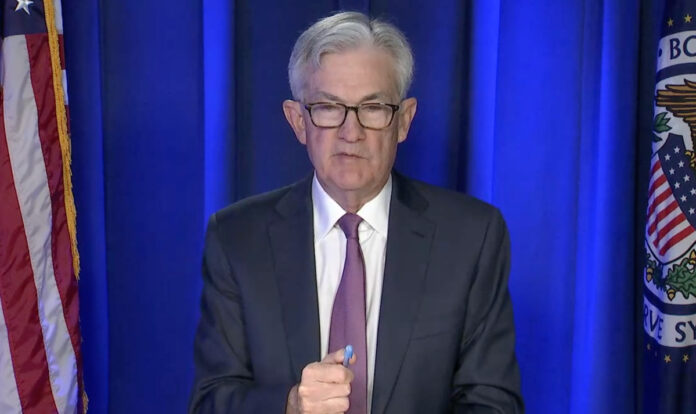

The Federal Reserve raised its benchmark interest rate by 0.25, a measure it has indicated will re-occur four or more times through the year as a matter of keeping inflation at bay. Fed Chairman Jerome Powell told reporters following the meeting that board will meet seven times through the year, and a quarter-point could be added again at each of those meetings as needed.

“The committee acutely feels the responsibility to restore price stability, and is willing to use all of its tools to do so,” Powell said.

First Trust Advisors Chief Economist Brian Wesbury stated in a recent newsletter to subscribers that the “futures market in federal funds appears split roughly 50/50” on whether the Fed will raise rates by 25 or 50 (0.25 or 0.5) basis points in May.

“Instead, we think the Fed should raise short-term rates to 2.0% and do it immediately,” Wesbury said. “No, we are not being cavalier about these suggestions, nor are we making them to get attention. Instead, it’s the Fed that’s been cavalier about inflation risk and now has the financial markets and economy in a position where we have to obsess over its every move.”