In early March analysts held the expectation of the Federal Reserve instituting a second rate hike of a quarter point, but a week marked by a stronger jobs report than anticipated and the failure of Silicon Valley Bank has most market watchers scratching their heads.

Total non-farm payroll employment rose by 311,000 in February, and the unemployment rate edged up to 3.6%, the U.S. Bureau of Labor Statistics reported on March 10.

The first glance at 86,000 more jobs than anticipated might point to the 0.50% increase, but the closer look at the jobs report showed growth in key sectors in need of employment and a lull in sectors that were do some right sizing.

Notable job gains occurred in leisure and hospitality, retail trade, government, and health care. Employment declined in information, and in transportation and warehousing.

“This jobs report managed a neat trick: Good news for both workers and the Fed,” Navy Federal Credit Union Economist Robert Frick was quoted as saying by Forbes. ”For workers, hiring continues to be robust, especially in industries that need people most: leisure and hospitality, retail, government and healthcare… That may blunt the Fed’s ardor for raising rates much more.”

The bank run in Silicon Valley added to that probability.

Silicon Valley Bank Failure Being Sorted Out, New York Institution Added to the List

The SVB failure has caused concern well beyond Menlo Park, Calif. The thought that other financial institutions could be at risk was accentuated March 13 with the regulatory shutdown of Signature Bank in New York. While the SVB loss has been characterized as “idiosyncratic” because of the nature of the bank — a majority of accounts held by large depositors — measures are being taken to achieve the needed stability for all institutions.

While the FDIC insures most U.S. deposits up to $250,000, that does little for accounts at an institution like SVB where customers are legacy clients fro the tech industry with holdings larger than the insured amount. A run on the bank ensued, and the institution cashed in bonds to pay out the withdrawals, which sent more customers asking for their cash.

Regulators are working to ensure solvency, through a sale or other means. President Biden has echoed industry regulators’ insistence that the problem will be resolved without depositors losing money.

As part of the security net, the Fed has stated it will allow banks that are well-collateralized with government guarantees access to loans that will help pay out any short runs on deposits, which would save the marketplace from a glut of sell-offs similar to the one that sent SVB into a spiral.

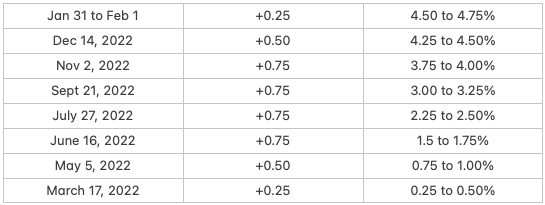

Fed Rate Hikes in 2022-23

“The board is carefully monitoring developments in financial markets,” the Fed stated in its March 12 release. “The capital and liquidity positions of the U.S. banking system are strong and the U.S. financial system is resilient.”

Silicon Valley Bank, which still held more than $200 billion in deposits, represents the second-largest U.S. bank failure in U.S. history, behind only to Washington Mutual’s $307 billion collapse in 2008.

Third on that list now is Signature Bank with a $118 billion collapse.

State regulators stepped in on Signature Bank, a large lender in the crypto space, to avoid a run-off on the heels of indications that the institution was unable to prove its ability to maintain stability in the case of higher-than-usual withdrawals.

Leadership at both banks will be replaced by third-party administrators who will pore over the books and look to correct course.

More on the Jobs Market

Both the unemployment rate and the number of unemployed persons, at 5.9 million, edged up in February. These measures have shown little net movement since early 2022.

The labor force participation rate was little changed at 62.5%, and the employment-population ratio held at 60.2%. These measures also have shown little net change since early 2022, and remain below their pre-pandemic levels.

The strong report gives some analysts and market watchers pause on what may have been an expectation for moderation in rate hikes when the Federal Reserve meets again in late March. After consecutive half- to three-quarter point increases through 2022, the Fed started the year with a 0.25 increase and was expected by many to hold that pattern.

Analysts agreed that the robust job report may be a signal to the Fed that its heavy push is not yet complete, but that was prior to news on the two failed banks.

The goal for the Fed is to alleviate inflation, which peaked last year near 9% and remains above 6%. The standard is for inflation to sit at about 2% to achieve market-wide price stability, for consumers and investors.

The Fed is scheduled to meet again on March 21-22.

Will it raise rates at all?

MHInsider is the leader in manufactured housing news, and product of MHVillage, the largest marketplace for manufactured homes and communities.