In its Quarterly Price Index Report on Home Values, FHFA Explores How Manufactured Homes Retain Value

In an experimental price index for manufactured homes, the Federal Housing Finance Agency shows manufactured homes retain value in a nature similar to other housing.

“With this HPI report, FHFA is making information about these indexes available for the first time,” the report states. “The indexes are largely experimental at this stage. The manufactured homes data used in forming these series include information for homes titled as real estate and not chattel.”

In Cooperation with Freddie Mac and Fannie Mae under ‘Duty to Serve’

FHFA used special loan data from Freddie Mac and Fannie Mae to produce a pair of new indices. The first is a purchase-only index, which accounts for purchase values. The second an all-transactions index that takes into account manufactured home appraisal values.

The approach for the new manufactured home value indices uses the same methodology employed by FHFA in creating its long-running quarterly house price index. However, the new indices to shed light on how manufactured homes retain value pools national data on the homes. The 40-year HPI uses state-by-state data.

FHFA reported that the difference derives from limited access to data sets in regard to the purchase of manufactured homes.

The base year for both indices is 1995, with an arbitrary weighted value of 100 assigned at that point.

FHFA Purchase Only for Manufactured Home Value Retention

The home values trend in a very similar fashion. We see a bit more annual volatility among the early data set on manufactured homes. Notice how the nearly identical peaks in the third quarter of ’07 result in similar volatility in the site-built data? Clearly, the first quarter of 2012 shows a deeper trough for the manufactured home data.

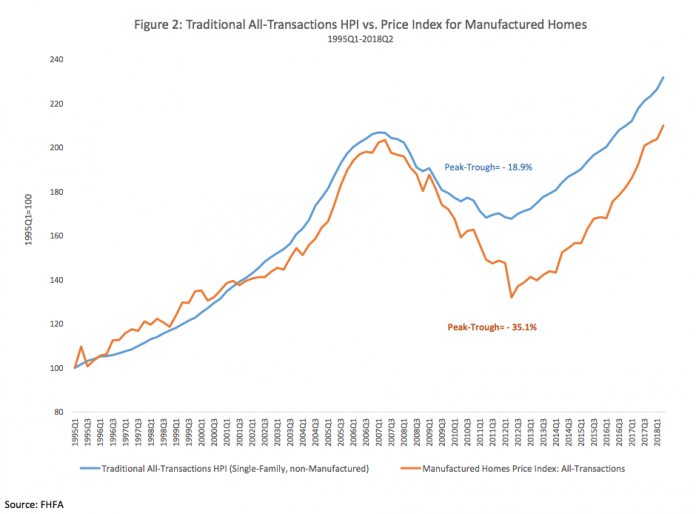

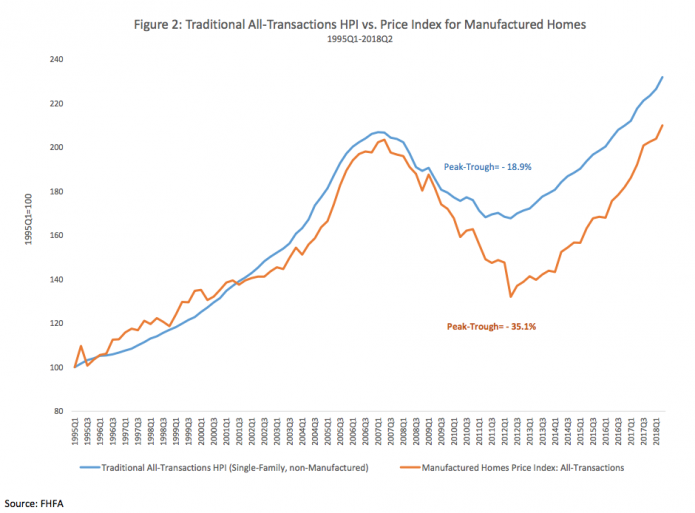

FHFA All Transaction for Manufactured Home Value Retention

So, on the all-transactions set that includes home appraisals, the shape stays largely the same with a bit less volatility between 1995 and the height at 2007, then both products tend to rattle a bit more on the down trend.

“In general, the figures suggest that manufactured homes have seen price trends broadly similar to those of other homes. According to the purchase-only series, since 1995, prices have risen by roughly 120 percent for manufactured homes vs. 140 percent for other homes,” the report states.

“Although the manufactured homes index had a lower trough, it has been steadily converging on the traditional site-built series, as evidenced by its larger gains over the past four years,” it said.

Data Sets Relative to MH Index Weighted for Metro Representations

FHFA put together a third snapshot comparison of the two home types. Manufactured homes tend to have less presence in metro areas. Consequently, the agency weighed the data to eliminate geographic differences.

“To provide more of an apples-to-apples comparison of price trends, a new index for manufactured homes is calculated with a dataset that up-weights transactions in metropolitan areas,” the report states. “The new sample reflects roughly the same proportion of transactions in metropolitan areas relative to FHFA’s traditional (purchase-only) sample.”

Notice the gap between the non-manufactured and manufactured property indices that grows slightly when comparing the first and last figures.

In conclusion, similar indices may be offered in coming months and years. However, they’re likely to be produced less frequently than the standard HPI, the report states.

Please feel free to post comments in regard to what you read and see here. Is there any feedback for the FHFA? Let us know your thoughts and we can pass them on for you.