MHInsider and Fannie Mae collaborated on answering some frequently asked questions associated with the MH Advantage® financing program and qualifying homes. From the program’s basics to how appraisal work is managed, Fannie Mae’s Starla Sand, a national evaluation analyst, provided the answers for our FAQ on MH Advantage financing.

What is MH Advantage?

MH Advantage is an innovative homeownership option that pairs affordable mortgage financing with specially designed manufactured housing. Think of MH Advantage qualifying homes as a cross between a traditional manufactured home and a site-built home, designed to be indistinguishable from site-built houses from the exterior view (that is, designed with characteristics typical of site-built homes). You may have heard the term CrossModTM referring to these new modern manufactured homes, and while not all CrossMod homes are eligible for MH Advantage financing, many features of the two are consistent.

Exterior features of manufactured homes that qualify for MH Advantage include higher pitch rooflines, larger eaves, and lower-profile foundations typically not found on standard manufactured homes. In addition, the exteriors feature attractive, durable siding materials, roof dormers, covered porches, garages, and carports. The similarity with site-built does not end on the outside. The interior has high-quality finishes, including drywall, kitchen cabinets with fronts of solid wood or veneered wood, and various material options for counters, sinks, and tubs seen in new site-built homes.

What are the differences between standard manufactured housing finance and MH Advantage financing?

Fannie Mae purchases mortgages secured by manufactured housing titled as real estate using our standard MH or MH Advantage underwriting guidelines. MH Advantage financing offers terms similar to those traditionally offered for site-built homes, including down payments as low as 3%. MH Advantage homes are also built to blend into stick-built neighborhoods. Standard MH financing, for manufactured homes that don’t qualify for MH Advantage, provides conventional mortgage financing for more traditional manufactured homes.

When appraising a property, how would an appraiser distinguish between a standard MH and MH Advantage?

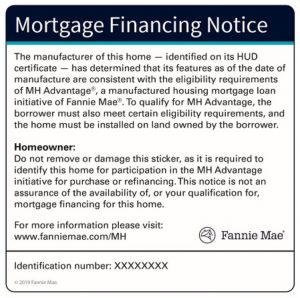

There are two ways for an appraiser to know that a home is MH Advantage-eligible. If an MH Advantage-qualifying home has already been built, the home will have an MH Advantage sticker near the HUD Data plates and HUD Certification Labels.

In the case of a home that has been ordered but hasn’t been built yet, it will be the responsibility of the lender to let the appraiser know that the home will be financed by an MH Advantage mortgage. We have a number of resources available at the Fannie Mae website that lenders can share with appraisers to help them get an accurate valuation for the property.

Regardless of the situation, it’s always a good idea to make a note in the appraisal that it’s for an MH Advantage home.

What is the MH Advantage manufacturer sticker, and where can it be found?

The MH Advantage sticker will be affixed to homes designed to meet MH Advantage eligibility criteria for easy identification by retailers, lenders, and appraisers. It is typically found inside the home next to the HUD Data plate. The sticker indicates that the structure of the home has been constructed to meet the MH Advantage requirements and makes it so that an appraiser can simply verify the presence of the sticker rather than verifying that many of the individual requirements for the structure of the house have been met. It greatly simplifies the appraisal process.

The MH Advantage sticker will be affixed to homes designed to meet MH Advantage eligibility criteria for easy identification by retailers, lenders, and appraisers. It is typically found inside the home next to the HUD Data plate. The sticker indicates that the structure of the home has been constructed to meet the MH Advantage requirements and makes it so that an appraiser can simply verify the presence of the sticker rather than verifying that many of the individual requirements for the structure of the house have been met. It greatly simplifies the appraisal process.

This sticker allows for the home to be financed by MH Advantage at both the retail point of sale and when it is sold to a new consumer. Many people don’t realize that the sticker applies to resale, too. Even if the original purchase is financed some other way, the MH Advantage sticker means that when a buyer is ready to sell, that home is still eligible for affordable MH Advantage financing.

What is the biggest challenge in appraising MH Advantage-eligible homes?

MH Advantage is relatively new, so the industry is unfamiliar with the product, what makes it unique, and its appraisal requirements.

What is being done to overcome that challenge?

Fannie Mae is committed to educating and training appraisers and appraisal management companies on this new property type.

- We have collaborated with McKissock, the nation’s largest appraiser Continuing Education (CE) provider, to create Appraising Today’s Manufactured Homes, a 7-hour CE course that explains Fannie Mae’s appraisal policies concerning MH with a deep dive and case studies on MH Advantage appraising.

- Appraisers can visit our appraisers page. It includes newsletters on appraisal topics, online help and training, and other resources. Questions can be submitted using the “Contact Fannie Mae about Appraisal Topics” link on the Appraisers page, which allows appraisers to get answers to their specific questions.

- We’ve also developed a landing page dedicated to MH appraisal at the Fannie Mae website. The page includes an MH Advantage Appraisal Training tutorial, MH Advantage Appraiser Requirements checklist, Q&As, and other relevant resources.

- We offer regular in-person and online training sessions to lenders, AMCs, and appraisal groups.

- We have a presence in industry events where we conduct presentations with Q&As.

Since the MH Advantage qualifying home is a cross between a traditional manufactured home and a site-built home, what appraisal form should be used? And, are manufactured home sales an appraisal requirement?

Since it is a manufactured home, appraisals must be completed using the 1004C form (manufactured home form). However, unlike a standard MH appraisal, two manufactured home sales are not an appraisal requirement.

How can an appraiser pick comparable sales when they appraise an MH Advantage eligible home?

The known challenge is that there are few or no MH Advantage sales currently available in many locations for sales comparison purposes. Based on our Selling Guide requirements, appraisers must use MH Advantage Homes for the comparable sales when available. If MH Advantage sales are not available, an appraiser can supplement with the best and most appropriate sales, which may include site-built homes, standard manufactured homes, or modular homes. The goal is to ensure an accurate appraisal that reflects the market value, condition, and marketability of the property.

What is not permitted to be used as comparable sales?

Appraisers are not permitted to create comparable sales by combining a vacant land sale with the contract purchase price of a home. However, a created sale can be added as additional support for value – slotted in as additional sale in the sales comparison approach section or in the addendum.

Are there appraisal requirements that are specific to MH Advantage?

Yes, for MH Advantage appraisals, the appraisers are required to provide photos of the HUD Data plate, HUD Certification Label, MH Advantage sticker, as well as the driveway, sidewalks, and detached structures located on the site. For purchase transactions, the appraiser must analyze the sale contract and manufacturer’s/retailer’s invoice for new manufactured homes, and they must provide a summary in the appraisal report and complete the cost approach.

What are the most common deficiencies with Manufactured Home Appraisals?

There are some cases where appraisers do not properly assess the quality of the subject property. As a result, appraisers have either used older, lesser quality MH sales or superior quality site-built homes, both without proper adjustments. This can result in an appraisal that does not accurately reflect the market value of the property.

How can appraisers overcome this?

The appraiser is responsible for determining if sufficient information exists to value the property. The appraiser should review plans, specs, and other documents to understand the exterior/interior features, characteristics, and quality of the home. It is good practice to visit manufacturer websites to view photos, videos, or virtual depictions or visit a dealer lot or model home.

What are the MH appraiser qualifications?

To qualify to complete this type of appraisal assignment, an appraiser must possess the knowledge and experience to understand the unique construction process of manufactured homes fully.

Is MH Advantage found primarily in rural markets, or are there subdivisions with MH Advantage?

We are seeing the MH Advantage qualifying homes getting some traction in rural markets and subdivisions. The same general appraisal requirements for new subdivisions apply for MH Advantage. The appraiser must select one comparable sale from the subject subdivision or project and one comparable sale from outside the subject subdivision or project. The third comparable sale can be from inside or outside the subject subdivision or project, provided it is a good indicator of value for the subject property. Two of the sales must be verifiable from reliable data sources, other than the builder.

Starla Sand is a national review appraiser for the Risk, Eligibility, and Valuation team in the Loan Quality Center at Fannie Mae, and she leads the MH/MHA appraisal training courses for appraisers, lenders, and real estate professionals. Starla is also active in the Affordable Housing space, working to provide affordable housing for low- to moderate-income homebuyers. With more than 28 years of experience as an appraiser, national reviewer, realtor, and educator, she brings insightful knowledge to share with the real estate industry. Starla has a bachelor’s degree in business from Wayne State College, Wayne, NE.

Information about the new MH Appraisal course

Fannie Mae has collaborated with McKissock, the nation’s largest appraiser continuing education provider, to create Appraising Today’s Manufactured Homes, a 7-hour CE course that explains Fannie Mae’s appraisal policies concerning MH with a deep dive and case studies on MH Advantage appraising.