There are a pair of new opportunities available for potential home buyers, each offered by one of the government-sponsored enterprises, Freddie Mac and Fannie Mae. The programs — CHOICEHome℠ and MH Advantage®, respectively — have many similarities and some differences.

We’re here to compare and contrast the new programs, so retailers and potential home buyers have a better understanding of how the programs work and which may be the best fit for the unique circumstances of a specific market and individual buyer.

What Do the GSE Programs do for Home Buyers?

Under the Duty-to-Serve mandate, handed down to Fannie and Freddie by the Federal Housing Finance Agency, the enterprises are charged with opening up financing and boosting the availability of affordable housing options.

CHOICEHome and MH Advantage are results of that initiative, both specific to manufactured housing (among the many measures taken across the affordable housing landscape).

These programs, with a price point in the range of $200,000 to $250,000, are not designed for low-income borrowers. They’re meant to be an alternative for would-be site-built homebuyers daunted by existing or new-construction homes that cost $350,000 to $400,000 in many U.S. markets.

What Homes Are Eligible for the Programs?

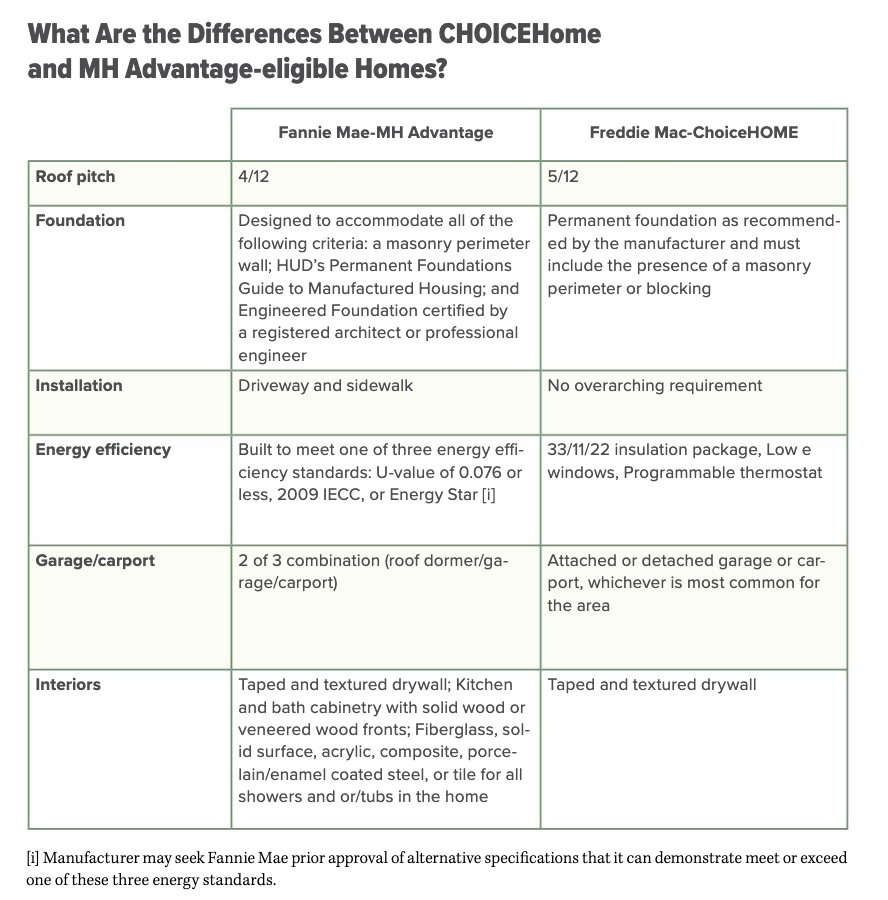

The loans from each program apply to manufactured homes that become eligible given certain aesthetic, energy-efficient and installation requirements. Eligible homes, simply stated, have many of the key characteristics of site-built homes. This achieves two goals: It allows the eligible homes to fit easily into many, if not most, existing residential settings, beside their site-built counterparts. It also allows appraisers to use site-built homes as comparable sales, as needed, in determinations of value that lead to improved finance terms.

For those uninitiated with CHOICEHome and MH Advantage, these changes may mean little or nothing. However, those who work in housing and housing initiatives understand that opening up conventional financing to factory-built homes is a major victory in closing the gap on getting affordable options in places where middle-market buyers want to live.

Each program requires the buyer to finance the home, as well as the land where the home sits.

This means homes placed in a land-lease community do not qualify for the new financing terms. However, the same entities, Freddie and Fannie, are continuing to explore chattel financing, which does apply to homes as personal property that can be placed on leased land.

Are the Two Comparable in Flexible, Affordable Terms?

Both the Freddie Mac and Fannie Mae programs provide flexible and affordable features to their lending programs. Each offers high loan-to-value ratios, up to 97%, and the manufactured home loan-level pricing adjustment doesn’t apply.

Appraisers can use the most appropriate comparable sale value available, including with site-built homes as necessary.

Who is Lending Using the New Freddie, Fannie Mechanisms?

Any Freddie Mac-approved lender is eligible to participate in the HOMEChoice program, as of May 1. Fannie Mae continues to build on its participating lenders’ list.