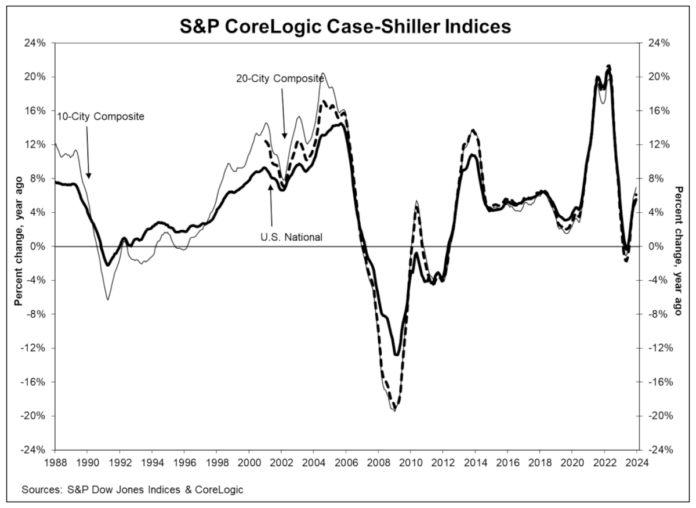

The S&P Corelogic Case-Shiller Index shows national home prices remain up 5.5 percent year over year, but have declined slightly each of the most recent two months for which reporting data is available.

Seventeen of 20 major metro markets reported month-over-month price decreases, the report released Feb. 27 stated.

The U.S. National Index showed a continued decrease of 0.4 percent, while the 20-City Composite and 10-City Composite posted 0.3 percent and 0.2 percent month-over-month decreases respectively in December.

“U.S. home prices faced significant headwinds in the fourth quarter of 2023,” S&P Dow Jones Indices Head of Commodities, Real & Digital Assets Brian D. Luke said. “However, on a seasonally adjusted basis, the S&P Case-Shiller Home Price Indices continued its streak of seven consecutive record highs in 2023. Ten of 20 markets beat prior records, with San Diego registering an 8.9 percent gain and Las Vegas the fastest rising market in December, after accounting for seasonal impacts.

“2023 U.S. housing gains haven’t followed such a synchronous pattern since the COVID housing boom. The term ‘a rising tide lifts all boats’ seems appropriate given broad-based performance in the U.S. housing sector,” he said. “All 20 markets reported yearly gains for the first time this year, with four markets rising over 8 percent. Portland eked out a positive annual gain after 11 months of declines. Regionally, the Midwest and Northeast both experienced the greatest annual appreciation with 6.7 percent.”

Looking Back at 2023

The year “appears to have exceeded average annual home price gains” over the past 35 years, Luke said.

“With trend growth at the national level of 4.7 percent, a 5.5 percent return demonstrates solid, steady growth. While we are not experiencing the double-digit gains seen in the previous two years, above trend growth should be well received considering the rising costs of financing home mortgages,” he said. “We previously suggested that the surge in home prices during the COVID pandemic could have accelerated home ownership temporarily. The past two years reflect consistent growth slightly above trend, suggesting a more secular shift in home ownership post pandemic. In the short term, meanwhile, we should be able to measure the impact of higher mortgage rates on home prices. Increased financing costs appeared to precipitate home price declines in the fourth quarter, as 15 markets saw lower values compared to September.”

MHInsider is the leader in manufactured housing news and is a product of MHVillage, the top marketplace for manufactured home and mobile homes.