‘May Soon Begin to See the Impact of Increasing Mortgage Rates on Home Prices’

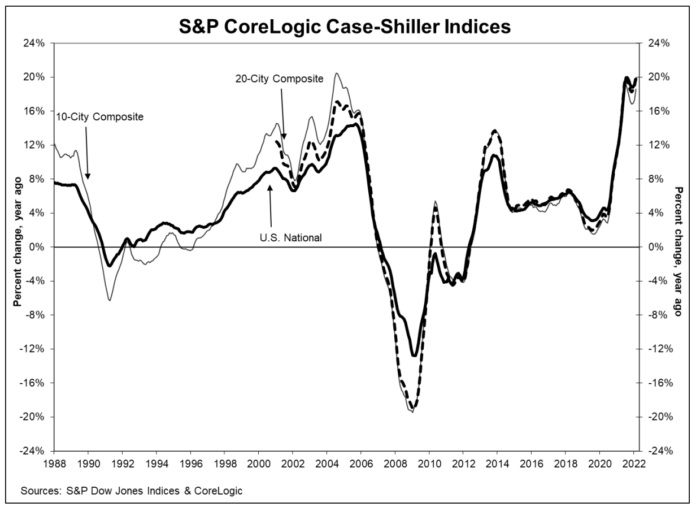

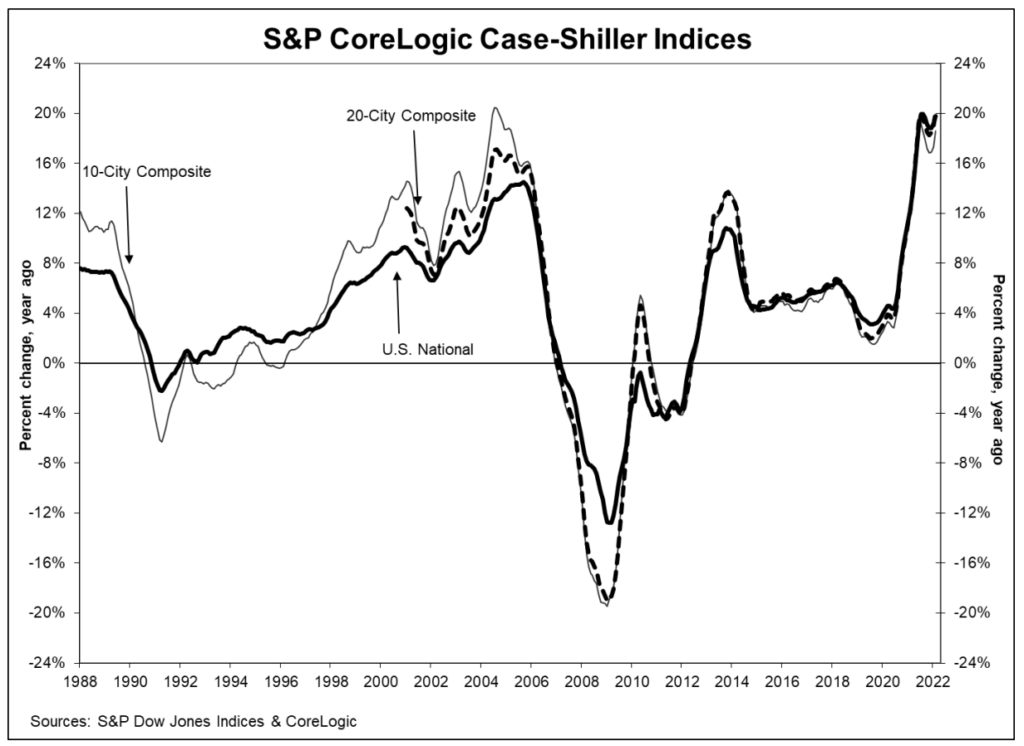

S&P Dow Jones on April 26 released the latest results for its monthly home price indices, showing February data that point to an acceleration again in pricing with a measure of 19.8%.

More than 27 years of S&P CoreLogic pricing history can be found at the indices website.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census

divisions, reported the 19.8% annual gain in February, up from 19.1% the previous month.

The 10-City Composite annual increase came in at 18.6%, up from 17.3% in the previous month. The 20-City Composite posted a 20.2% year-over-year gain, up from 18.9% in the previous month.

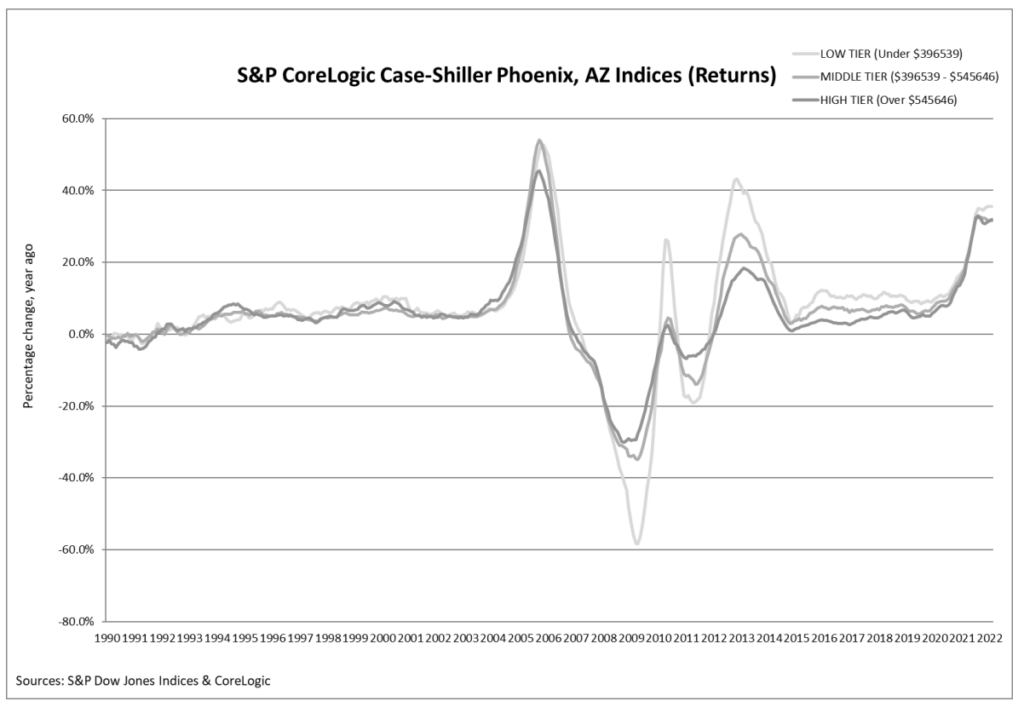

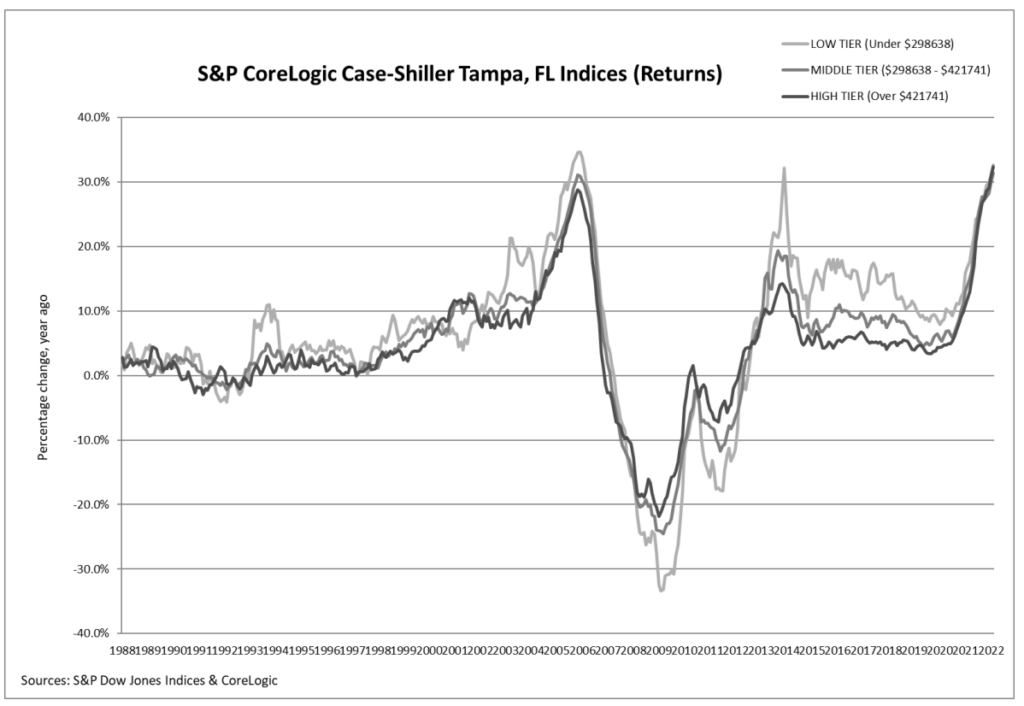

Phoenix, Tampa, and Miami reported the highest year-over-year gains among the 20 cities in February. Phoenix led the way with a 32.9% year-over-year price increase, followed by Tampa with a 32.6% increase and Miami with a 29.7% increase.

All 20 cities reported higher price increases in the year ending February 2022 versus the year ending January 2022.

“U.S. home prices continued to advance at a very rapid pace in February,” S&P DJI Managing Director Craig J. Lazzara said. “All three composites reflect an acceleration of price growth relative to January’s level.

“The National Composite’s 19.8% year-over-year change for February was the third-highest reading in 35 years of history,” he said. “That level of price growth suggests broad strength in the housing market, which is exactly what we continue to observe.”

Phoenix’s 32.9% price increase led all cities for the 33rd consecutive month, with Tampa and

Miami close behind. Prices were strongest in the South (+28.1%) and Southeast (+27.9%), but every region continued to show impressive gains.

“The macroeconomic environment is evolving rapidly and may not support extraordinary home price growth for much longer,” Lazzara said. “The post-COVID resumption of general economic activity has stoked inflation, and the Federal Reserve has begun to increase interest rates in response. We may soon begin to see the impact of increasing mortgage rates on home prices.”

Bookmark MHInsider for all of your manufactured housing news and check back often for updates on manufactured housing industry tradeshows, conferences, and meetings.