Stegmayer Plugs MHI’s Quality Representation on National Stage with Regulatory Relief in Washington

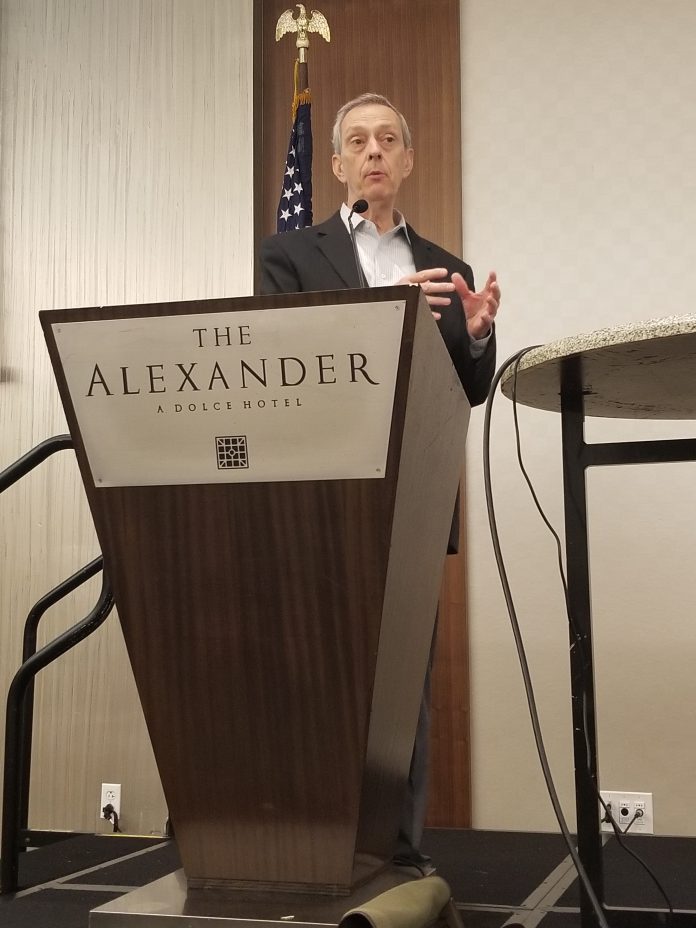

The 27th Annual International Networking Roundtable is underway in Indianapolis, headed

off by Cavco Industries Chairman Joe Stegmayer, who lauded the Manufactured Housing Institute for its work in Washington, D.C.

Stegmayer also is chairman of the board for MHI. He said with limited membership and budget, MHI has been able to lobby and propagate positive change on par with other, much larger and more well-funded trade associations.

“We’ve made a lot of progress on laws and regulations that affect our industry,” he said. “We’ve had 100 meetings on Capitol Hill with legislators and their staffs. To think that MHI is getting this done is pretty amazing.”

Areas of Positive Change on Regulatory Relief in Washington

- Turn-back of Dodd-Frank language that prohibited home sellers from mention of finance terms

- Initiation of discussion and education leading to HUD top-down review of manufactured housing rules

- Lobby against federal overreach on prohibitive regulations regarding frost-free foundations, garage and porch-ready homes, transport and install of French door systems

- Continued work on opening chattel financing for manufactured homes, including secondary markets

With housing prices rapidly and continually rising, the surging demand from millennials and retirees, manufactured housing has presented itself as an answer to the housing crisis, if not “the answer”, he said.

“We’re affordable housing without the subsidies,” Stegmayer said. “Not a lot of people know that, and MHI, the RV/MH Hall of Fame are institutions that provide platforms to send this message.”

Dodd-Frank Change is a Big One for Regulatory Relief

Until MHI’s lobby efforts took hold, retailers in all areas of the business — from street dealers to community operations — had a difficult time selling homes because federal law said they couldn’t talk about approximate loan payments and terms.

“I think that really tied the hands of home sellers,” Stegmayer said. “And it made the buyer leery of ‘why wouldn’t they tell me what my approximate loan payment would be?'”