Industry Experts in Sales, Marketing, Lending Provide Educational Insight to MH Pros in Tunica for 2019 Show

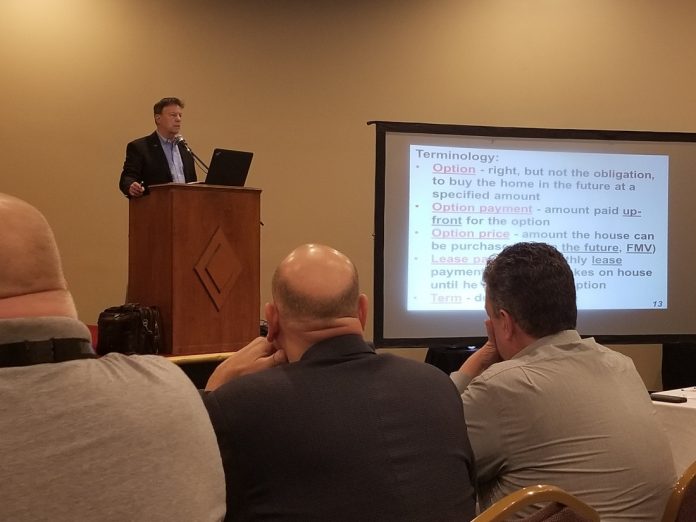

Spencer Roane, the principal for Pentagon Properties, opened the educational seminars for MH pros at Tunica talking about the value of lease-with-option-to-purchase transaction for potential homeowners.

Roane said the program, also often referred to as lease-to-own, or L-O, became a necessity with the implementation of the SAFE acts and Dodd-Frank legislation. It’s also often mistakenly referred to as rent-to-own.

“Compliance is something we should be careful of, and pay important attention to,” Roane said.

How Does L-O Differ From Rent-to-Own Programs?

Pricing is a key component. Sellers need to ensure their customer gets market value on both payments and total purchase price.

“That’s what separates a lease agreement from a rent-to-own program, which is something you might use the buy a refrigerator,” he said.

Roane said early in the program he and other colleagues experienced default rates that were too high. In recent years, Roane’s company has fine tuned the product and the target customer to drastically improve the rates of success.

The L-O customer is one with moderate to poor credit who likely would be unable to secure a mortgage or chattel loan. Leasing to own provides the opportunity to be a homeowner. This includes purchases for new or existing manufactured homes.

Manufactured home sales in communities via lease-with-option-to-purchase (LWOP or L-O) is an acceptable form of “seller-financing” in many states, he said.

List of Topics Covered in Lease-to-Own Home Sales Presentation

- The fine points of the L-O contract; including specific provisions of the contract.

- Why the contract “passes muster” in some states, and where copies of documentation may be obtained.

- Home sales program, qualification of buyers, factors he considers most important in reducing defaults. And statistics on his firm’s sale of new and previously owned manufactured homes.

- Alternatives to L-O, including innovative conventional chattel finance options.

Information on The Tunica Show

Thousands of MH pros go to Tunica, Miss., each spring for the southeast’s premier event in manufactured housing. The exterior of the Hollywood and Resorts Casino and Hotel has 70 new model homes from 24 manufacturers that attendees can tour. The Tunica Show is the biggest outdoor home show of its kind! And, the supplier hall has 100 exhibitors that the 2,300 attendees from more than 500 companies can survey and consider for future business plans.

Sales Consultant Leads MH Pros in Tunica Toward Best Practices

Ken Corbin, a manufactured housing industry sales consultant, spent 40 minutes describing to MH pros in Tunica how their customers are changing. And how that can be a great opportunity for home sellers!

“When you start a venture everything is great. But eventually you’ll hit a plateau,” Corbin said. “Everything will flatten out. That’s where you need to make a decision. Will you change and make things better, or will you continue to plateau? If you don’t change, you’ll decline.”

Manufactured housing professionals in Tunica were reminded that it was not so long ago that the industry delivered 375,000 homes in a year. By 2009, 87 percent of that business went away and 10,000 manufactured housing industry companies folded.

Corbin asked how industry professionals today can avoid that, or a similar fate.

“We could sell more. Spend less. Increase margins… or a fourth way: Don’t grow old. Then you’ll become 10,001. And we don’t want that to happen.”

The goals for 2019 is to sell 100,000 or more homes

Corbin pointed out that a new manufactured home today costs $57.21 per square foot excluding land; new site built homes cost $108.10 per square foot.

“Today we’re more affordable than we’ve ever been,” Corbin said.

But manufactured home sellers need to meet potential buyers where they prefer. Sales center walk-ins won’t get it done.

Research shows that 86 percent of millennials want to buy a home. But if you call, they may not answer. Millennials primarily prefer to text prior to a live conversation.

“Millennial homeuyers will disrupt market over next five years,” Corbin said. “Ninety eight percent of them will search online for info on your homes before they visit. They’re twice as likely to use their devices as is a Baby Boomer. Technology will play a central part in their homebuying decision.”

MHInsider Managing Editor Matt Milkovich contributed to this report.