A Quarterly Review of Manufactured Housing Real Estate Investment Trusts

The research team at Hoya Capital Real Estate is excited to continue our quarterly column published in partnership with MHInsider to provide insight and commentary on publicly-traded manufactured housing stocks. Every quarter, we’ll publish an update to discuss the stock performance, earnings results, and major news and events reported by manufactured housing real estate investment trusts, or MH REITs.

Overview of MH REITs

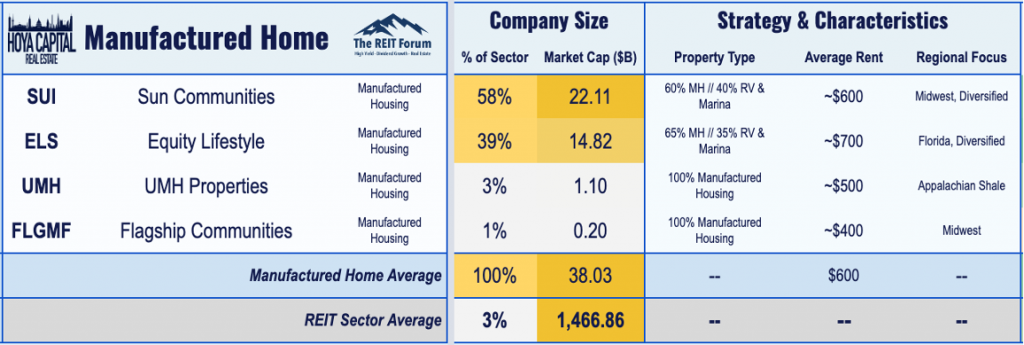

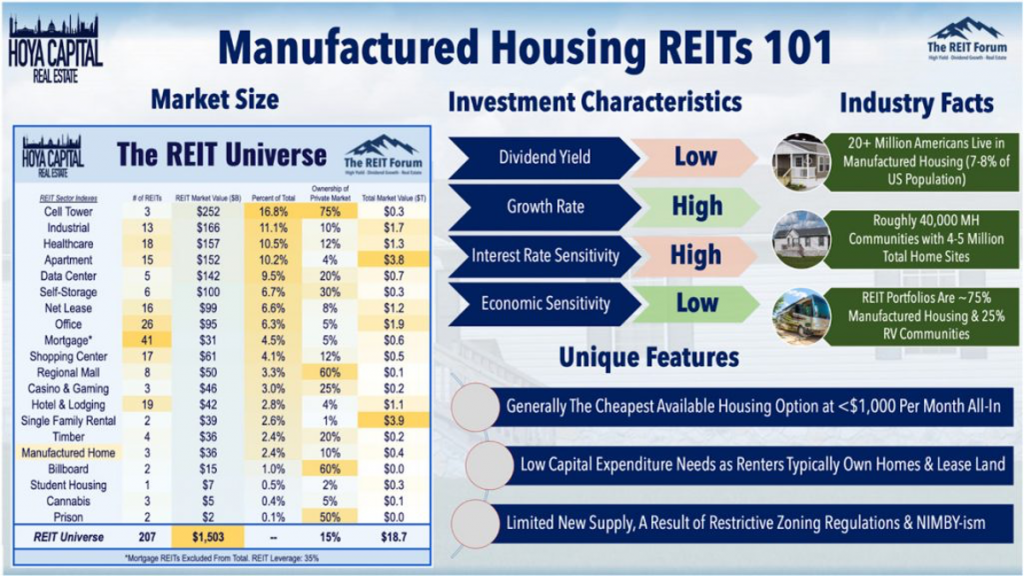

There are three U.S. exchange-listed Manufactured Housing REITs which collectively account for roughly $40 billion in market value: Equity Lifestyle (ELS), Sun Communities (SUI), UMH Properties (UMH). Additionally, newly-listed Flagship Communities (FLGMP) trades on the Toronto Stock exchange.

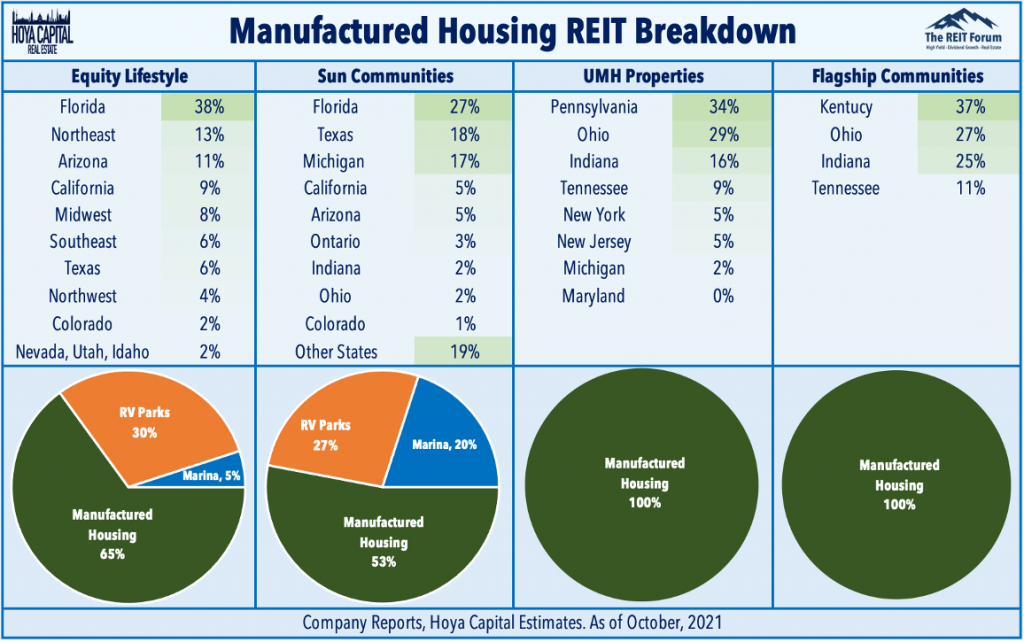

Manufactured Housing REITs collectively own roughly 350,000 manufactured housing and RV sites across the United States with a portfolio skewed toward higher-end communities with a more “retiree-oriented” demographic than the all-ages community. Through a series of acquisitions, Equity Lifestyle and Sun Communities have recently expanded into boat marinas as well while the smaller UMH Properties and newly-listed Flagship Communities focus on traditional manufactured housing communities.

Through a series of acquisitions, Equity Lifestyle and Sun Communities have recently expanded into boat marinas as well while the smaller UMH Properties and newly-listed Flagship Communities focus on traditional manufactured housing communities.

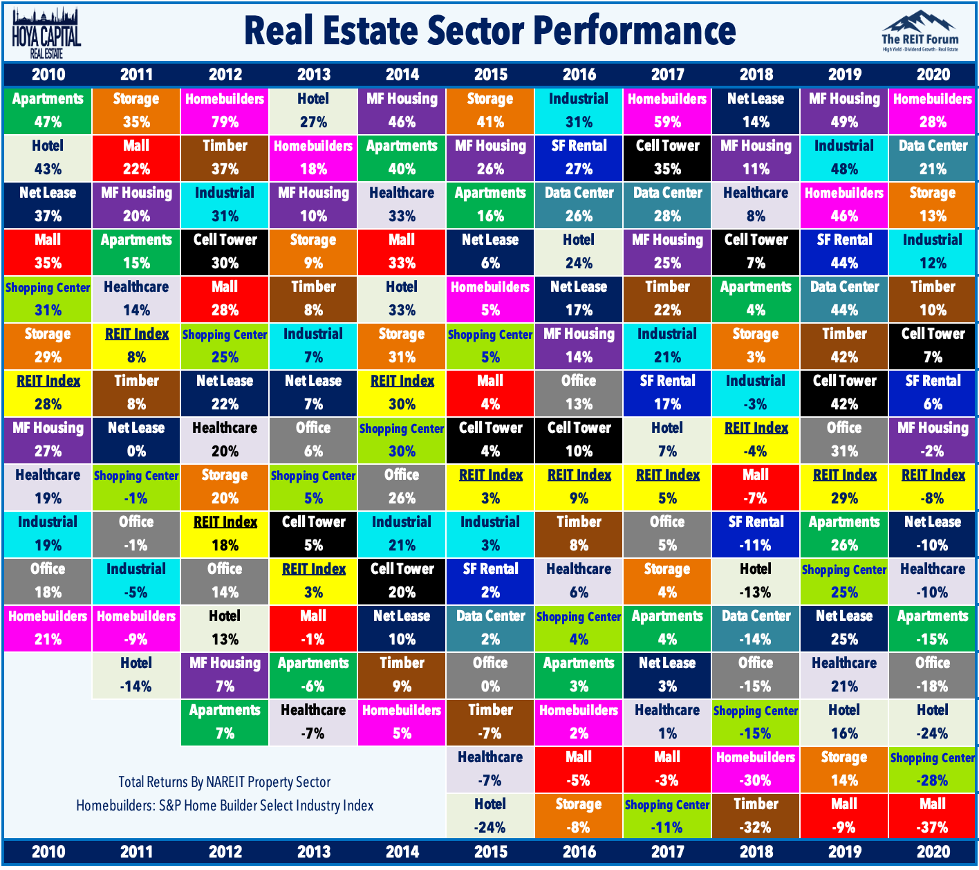

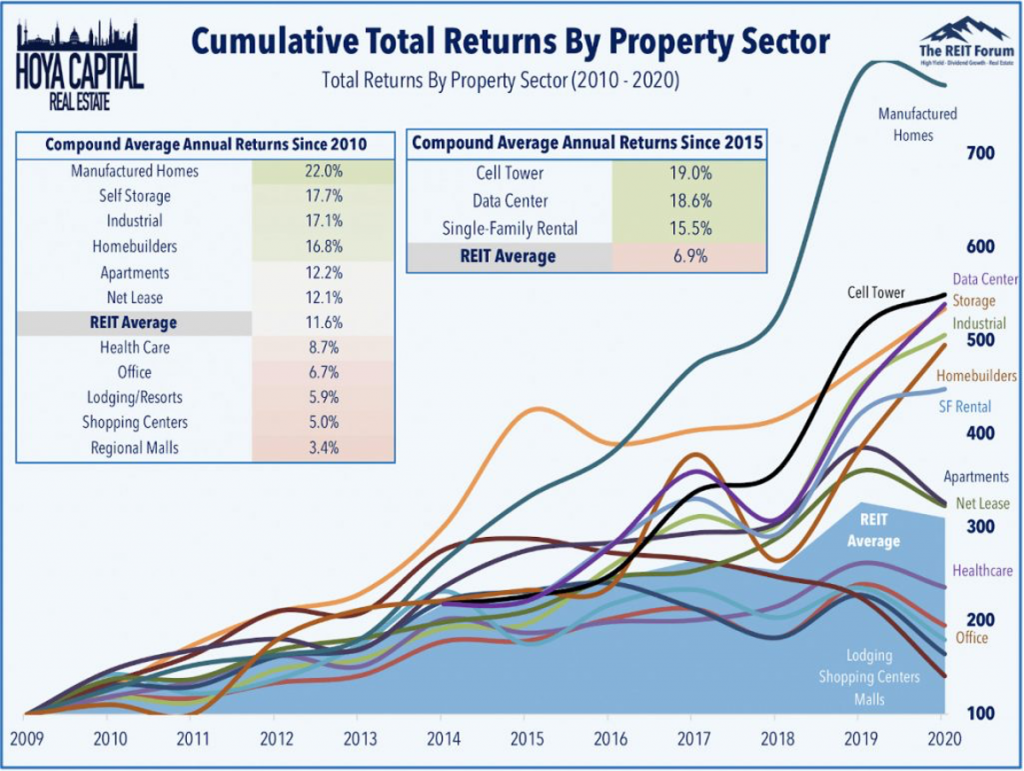

Manufactured housing REITs have emerged over the past decade from relative obscurity into several of the largest publicly-traded owners of real estate in the world. Beneficiaries of the lingering housing shortage across the United States resulting from a decade of underbuilding, manufactured housing REITs have been the single-best performing REIT sector since the start of 2010, delivering an incredible 22% annual compound total returns from 2010 through 2020.

Third Quarter 2021 MH REITs Performance

MH REITs soared nearly 15% in the weeks following their stellar second-quarter earnings reports – and were briefly the second-best-performing REIT sector on the year – but have given up some of these gains in recent weeks given the recent concerns over rising rates and inflation.

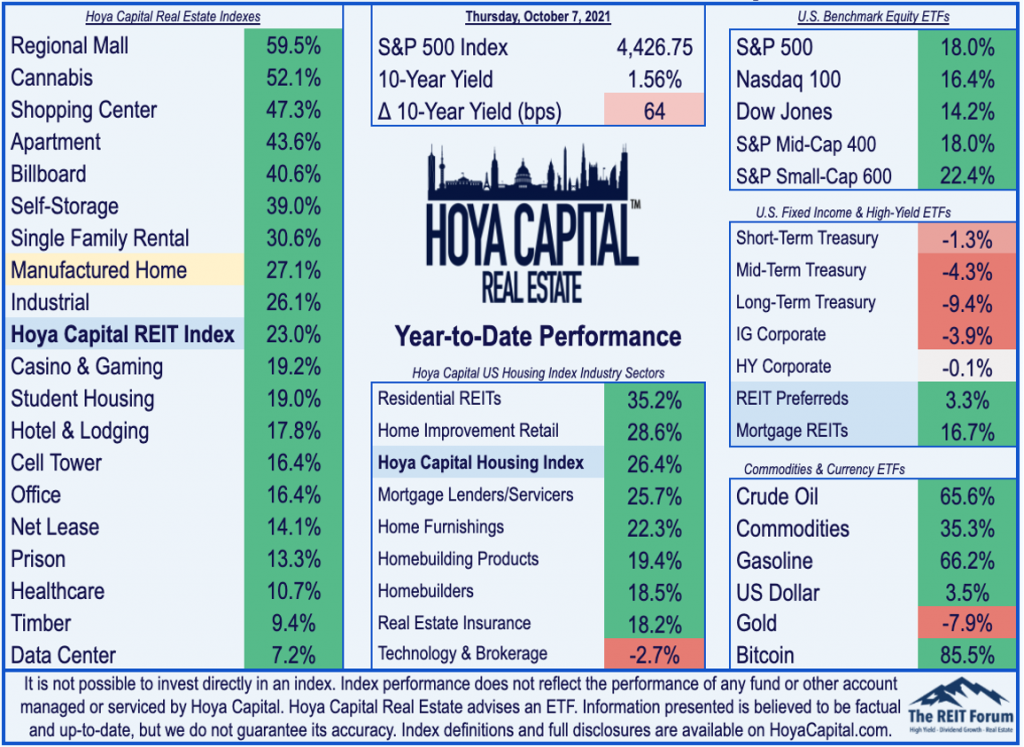

Despite the roughly 10% correction from recent highs set in early September, MH REITs are still higher by 27.1% this year, still outpacing the 23.0% gains from the market-cap-weighted Vanguard Real Estate ETF (VNQ), and beating the 18.0% returns from the S&P 500 (SPY) and 18.0% gains from the Mid-Cap 400 (MDY).

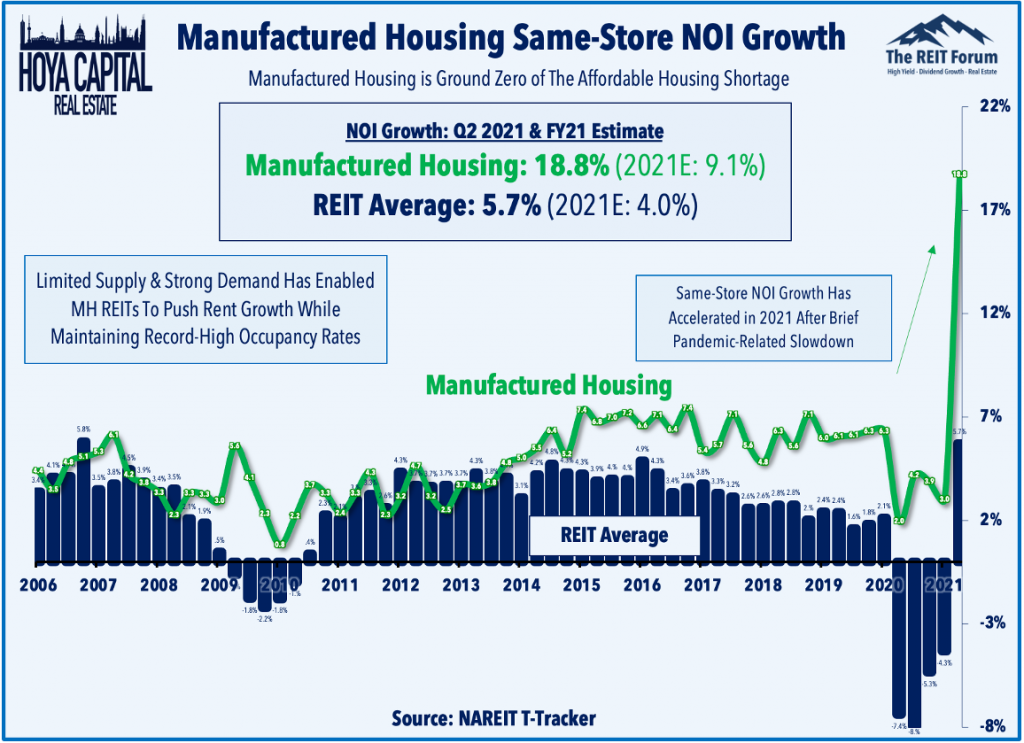

Consistent with the trends across the residential REIT industry over the past quarter, MH REITs significantly boosted their growth outlook over the last quarter, citing strong rental housing demand and substantial upward rent pressure. Same-store Net Operating Income (“NOI”) growth continues to accelerate following a brief pandemic-related slowdown as property-level growth is now expected to rise by more than 9% for full-year 2021, up from the prior outlook which called for roughly 6% NOI growth.

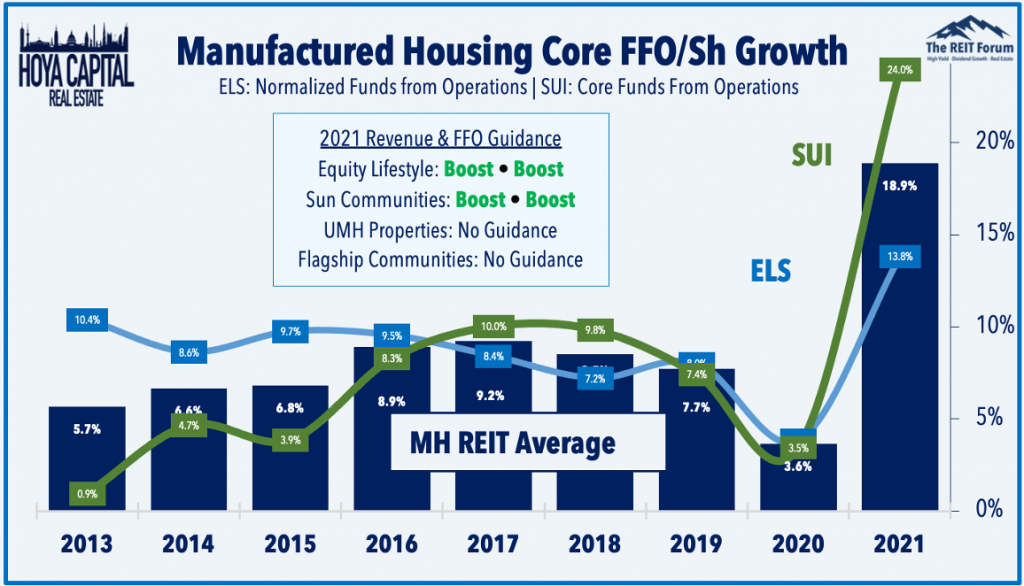

Growth in funds from operations – the earnings per share “equivalent” for REITs – is driven by the combination of same-store “organic” growth and by external growth through acquisitions and new development. Forward guidance over the past quarter was particularly impressive as ELS and SUI project growth in Funds From Operations (“FFO”) of nearly 19% this year – up from their prior outlook of 14% growth last quarter – which would surely be one of the strongest growth rates in the REIT sector.

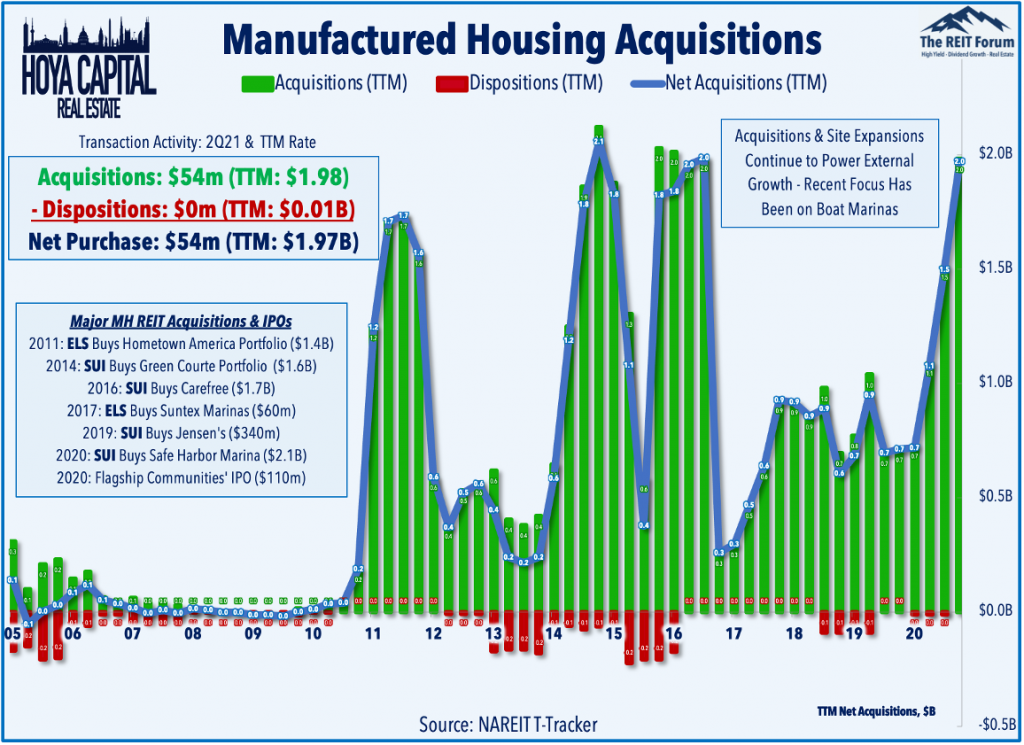

Utilizing a strong cost of equity capital, these REITs have continued to grow externally by adding units to existing sites and by growing via acquisitions and site expansions. MH REITs acquired just shy of $2 billion worth of properties over the last year, largely in one-off acquisitions while disposing of just $10 million in assets. The most significant deal in 2020 was Sun Communities’ $2.1B purchase of Safe Harbor Marinas, which owns and operates 101 institutional-quality boat marinas.

Manufactured Housing Industry Data Points

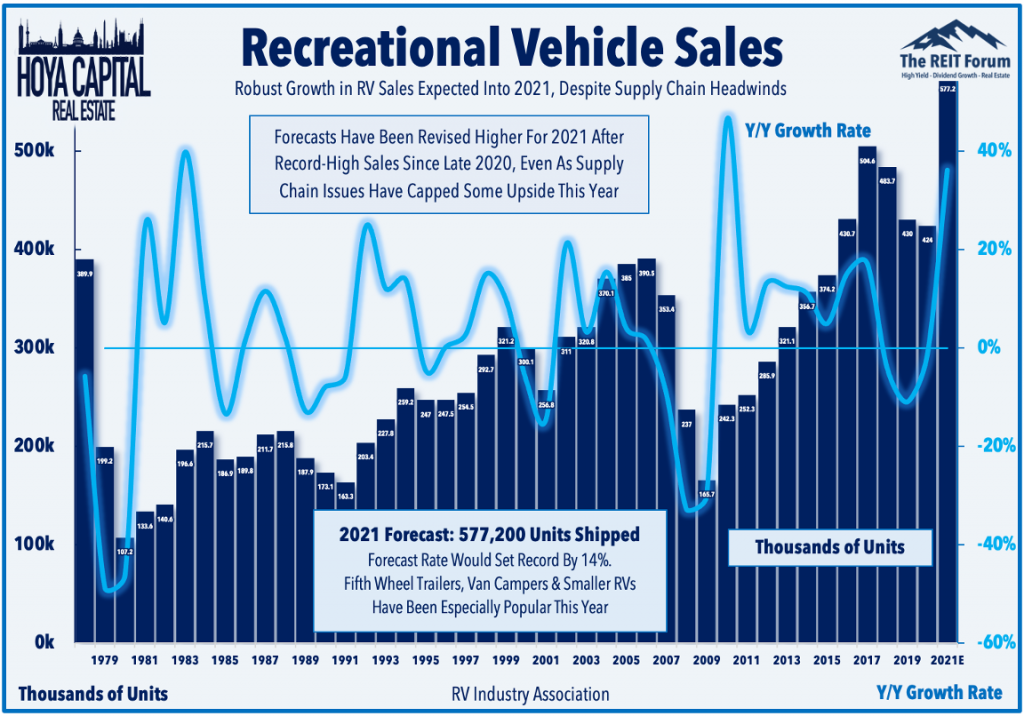

MH REITs’ amplified focus on analogous asset classes – RV parks and marinas – was perfectly-timed, providing an added external growth tailwind. “Work-From-Anywhere” has fueled soaring RV, boat, and vacation home sales. The RV Industry Association expects RV wholesale shipments to climb to their highest historical total ever. While the RV industry has faced similar supply chain issues as traditional homebuilders, the RVIA sees shipments rising to 577k units in 2021, which would be a 14.1% gain over the current comparable record high of 504,600 units in 2017.

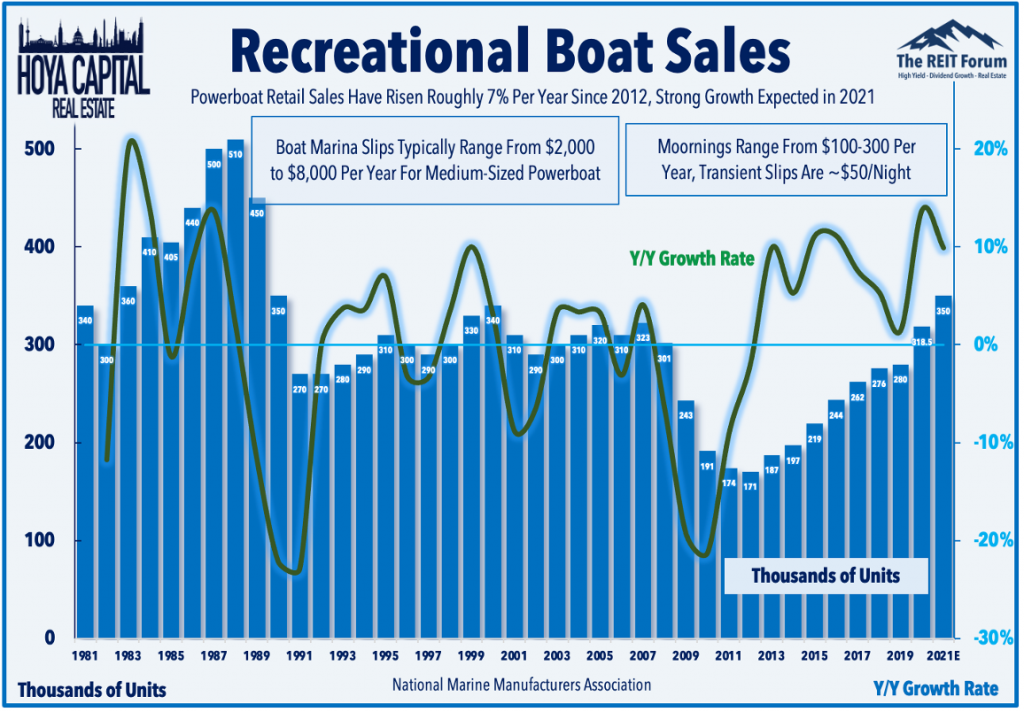

The National Marine Manufacturers Association, meanwhile, reported that powerboat sales are also poised to set record-highs this year despite inventory levels that are “the leanest they’ve ever been.” With SUI’s major investment in Safe Harbor Marinas, these MH REITs are now the two largest owners of marinas in the United States, an asset class with nearly identical fundamental characteristics as their large portfolio of RV parks. Marinas offer substantial operating parallels to the company’s RV business and that there are roughly 4,500 marinas in the US, of which 500 would be considered “institutional quality.” Earlier this year, ELS also expanded its marina portfolio with a purchase of 11 marinas, containing 3,986 slips, for $262.0 million.

MH REITs Key Takeaways

Low supply and strong demand have driven stellar fundamental performance for MH REITs over the past half-decade, and the MH sector continues to deliver sector-leading NOI and FFO growth. Consistent with the trends across the residential REIT sectors over the past quarter MH REITs significantly raised their growth outlook, citing strong rental housing demand and substantial upward rent pressure. Despite reporting stellar results throughout the year, manufactured housing REITs’ remarkable streak of eight straight years of outperformance over the REIT Index will come down to the wire in 2021 as the sector has been pressured over the past month by concerns over rising rates, inflation, and the broader rotation from growth into value.

“Beneficiaries of the lingering housing shortage – creating a compelling backdrop for companies across the housing industry – we believe that the recent pull-back could represent the long-awaited buying opportunity for these dividend growth champions.”

— Hoya Capital

MH Earnings Reports

Looking ahead, MH REIT earnings season kicks off on Oct. 18 with results from Equity Lifestyle. Over the subsequent three weeks, we’ll hear results from Sun Communities, UMH Properties, and Flagship Communities, in that order.

MH REITs REPORT Terms Defined

FFO (Funds From Operations): The most commonly accepted and reported measure of REIT operating performance. Equal to a REIT’s net income, excluding gains or losses from sales of property and adding back real estate depreciation.

AFFO (Adjusted Funds From Operations): A non-standardized measurement of recurring/normalized FFO after deducting capital improvement funding and adjusting for “straight line” rents.

NOI (Net Operating Income): Typically reported on a “same-store” comparable basis, NOI is a calculation used to analyze the property-level profitability of real estate portfolios. NOI equals all revenue from the property, minus all reasonably necessary operating expenses.

Hoya Capital Disclosures

I am/we are long ELS and SUI. I am not receiving compensation for it. It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Nothing on this site nor any published commentary by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and should not be considered a complete discussion of all factors and risks. A complete discussion of important disclosures is available on our website www.HoyaCapital.com.

Bookmark MHInsider for the latest in manufactured housing news, and to keep up on all of the manufactured housing industry trends.