Managing Your Managers Part Two- Lead Management

MHVillage has been a part of this industry long enough to know what consumers have come to expect when buying a home or moving into a community. If your company manages multiple communities, this article will help you manage your managers with respect to lead management practices.

As the industry continues to grow we continue to see professionals from other industries join us. We also see more companies acquiring multiple communities and adding to their portfolios. These situations combined can provide obstacles when it comes to streamlining the management of the managers at each property.

This article is the second in a three-part series that focuses on managing your community managers. (Check out part one focused on Marketing).

Why Lead Management is Important

According to Forbes, on average businesses waste 71 percent of their leads with only 27 percent of leads ever getting contacted and 35 to 65 percent never getting called at all.

(See the full article on “Why Companies Waste Their Internet Leads”)

Effective and efficient lead management is a key element when it comes to closing a sale of a home in a community or securing a valuable long-term resident. The more properties you have in your portfolio the more necessary a lead management strategy.

How and when is your next resident shopping?

Knowing how and when your customers are shopping are important details. This information helps refine your advertising, keeps your lead response time as short as possible and just, in general, better prepare your managers for the job at hand.

Some areas, depending on location, tend to get a lot of foot traffic, specifically on the weekend, while others might see a ton of website traffic and during the work week. To gather this information start with reviewing your website and online advertisements traffic. As for foot traffic, try extending your office hours 1 or 2 days of the week.

Fun Fact: The heaviest traffic on MHVillage’s mobile site is on Sundays, peaking at 8:00PM

Be prepared when your audience calls

Your managers need to have all of the information available and ready to give potential residents. Whether this is current digital PDFs with information that is easy to print or a sleek website to refer to that has accurate costs and contracts available. Having the necessary paperwork on hand and readily available shows your potential resident that you value their time and your community is organized and supportive.

Response time is everything

A large part of your plan for managing your managers should focus on the importance of response time. The closer your manager’s response can get to the 5-minute mark, the more likely they are to qualify and eventually convert a lead to a resident. There have multiple studies and research that has shown the age old “early bird gets the worm” adage remains a thriving bit of advice.

Most of us know the 5-minute mark has been proven to be 50 percent more likely to close a sale. Lately, we are getting closer to a 2 to 3-minute mark if possible. With the fast pace of our world consumers, in general, are getting more accustomed to instant gratification and instant response times. Making sure your managers plan and are supported to achieve satisfaction in this area.

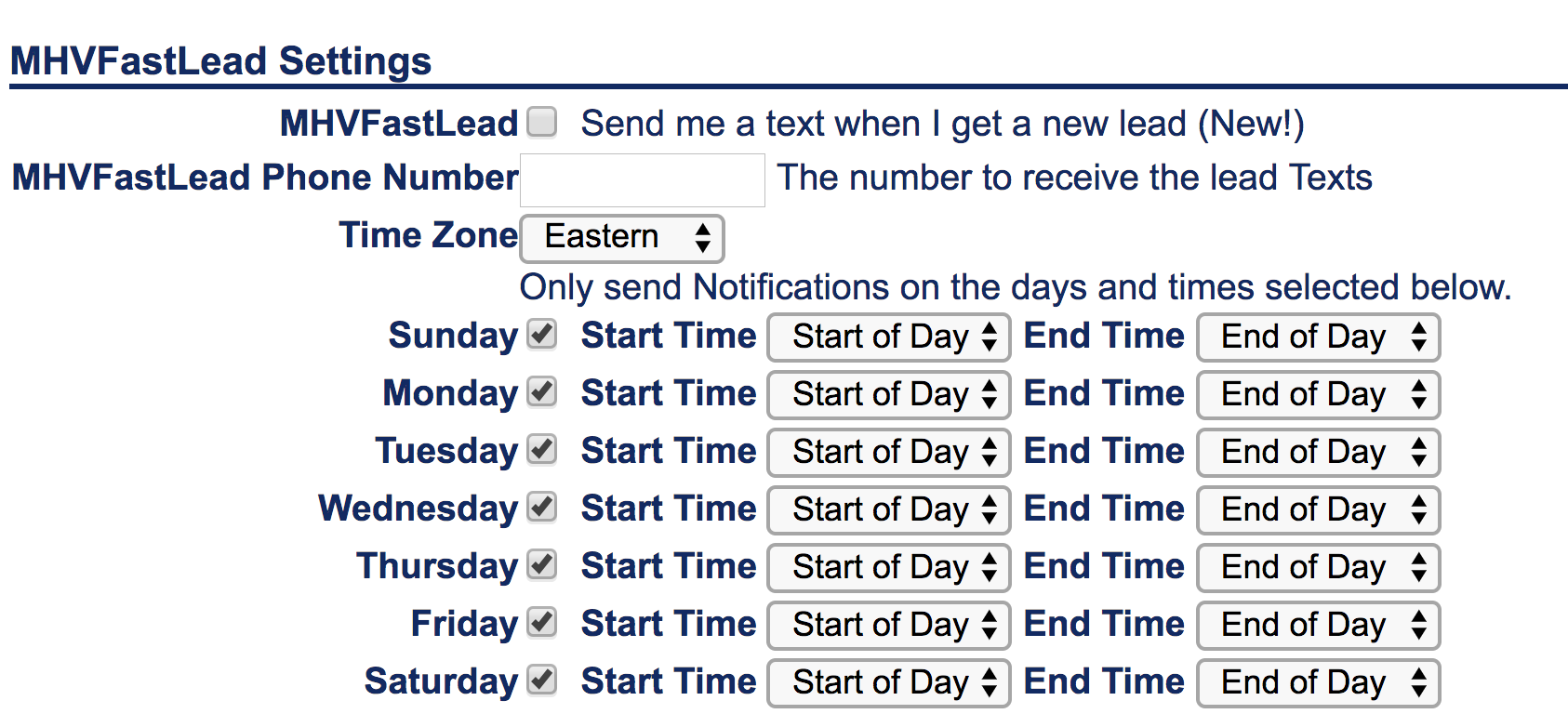

MHVillage offers the MHVFastLead which you can set up within your account. This feature allows you to receive a text notification from our website whenever we send you a lead. (Note the lead itself will still be sent to the email on the listing, this notification just lets you know we sent it!). This feature is also free and included in every account!

To set this up, simply log into your account and head to the “Update Account Information” page. The details and timeframe options are all listing there towards the bottom of the page.

To set this up, simply log into your account and head to the “Update Account Information” page. The details and timeframe options are all listing there towards the bottom of the page.

How do your managers keep up?

A strategic plan and established system in place provide your team with support and tools to effectively meet the above goals.

“70 percent of the buyer’s journey is completed before they even get in touch with a sales rep”

Companies with multiple properties often establish a system where they categorize their leads by importance and reply in order. Another option would divide the different lead types and send them to different departments or sales reps in an effort to maintain the quick response time needed.

MHVillage sends the leads via email directly and in real time, but we also store them within the account. The lead section in the account also has the option to download them in spreadsheet form. This option lets you manage all of the leads generated from MHV in a convenient and easy to manage spreadsheet.

The art of following up

Following up is crucial in showing your potential residents that you care about them. Typically, a follow up via email can be the most effective. This is the case as long as you provide them with the information they need. Not only can an email follow up be convenient and faster it also provides a paper trail.

A good follow up email will contain the following key details:

- Customer’s Name

- Details about the home(s)

- Additional home options that might be similar

- Your direct contact information

Another tip would be to offer a time-sensitive incentive for the customer that would encourage them to reply sooner!

Hopefully, this information can help you and your team effectively manage the leads you receive your multiple properties.

If you have any additional questions about MHVillage and the lead management options we offer on our site, be sure and contact our customer service.

We’ve written before on some simple

We’ve written before on some simple

Once you have decided how you want to brand the communities, the next step is creating a marketing plan to deliver to the community managers. This step is crucial in effectively managing the representation across the board.

Once you have decided how you want to brand the communities, the next step is creating a marketing plan to deliver to the community managers. This step is crucial in effectively managing the representation across the board.

The new Indiana state law will go into effect on July 1.

The new Indiana state law will go into effect on July 1.