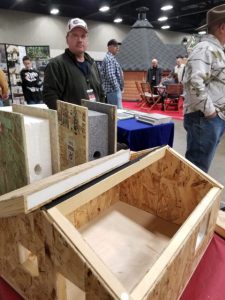

New MHInsider Magazine for Manufactured Housing Industry Professionals Gains Initial Circulation Jan. 17-19 at 2018 Louisville Manufactured Housing Show

MHVillage, the nation’s number one website for manufactured housing, has launched the MHInsider magazine, a new print publication for manufactured housing industry professionals.

The new magazine will debut at the 2018 Louisville Manufactured Housing Show Jan. 17-19.

The introductory issue of the MHInsider is a 50-page, full-color print publication. The magazine contains editorial contributions from industry experts that range on topic from new home trends to water submetering, MH sales tips and community profiles to briefings on the latest in industry finance and lending.

“Following the successful launch of the MHInsider blog for manufactured housing professionals, it became apparent there was an opportunity for an associated print magazine,” MHVillage Co-President and Chief Business Development Officer Darren Krolewski said. “For a large number of MHVillage customers, the MHInsider magazine will serve as the preferred format for picking up the latest and most relevant news from the manufactured housing industry.”

The MHInsider Magazine Fills Industry Void

The manufactured housing industry has been without a print trade publication since the last industry journal discontinued publication in December 2016.

The manufactured housing industry has been without a print trade publication since the last industry journal discontinued publication in December 2016.

“Professionals who have been in the business for much of their careers remember the names of the many publications that have come before us,” Krolewski said. “We recognize those contributions and legacies, and while some aspects of our publication will harken back to the publications we have enjoyed, the MHInsider will look forward, as well, in ways that will be noticed and appreciated by the many manufactured home ‘insiders’ we look to serve.”

MHVillage assists in selling, purchasing, and renting manufactured housing.

Each year, MHVillage registers approximately 25 million unique visitors. In 2017, MHVillage boasted 148 million page views, providing a platform for more than $3 billion in home sales and rentals. MHVillage also provides services to consumers and professionals in the areas of home building, retail, community management, brokerage, investment and finance.

The intent for the MHInsider magazine is to expand the informative, industry-positive conversation that strikes a balance between feature profiles, industry trends, and the latest news.

Industry Reaction to The MHInsider Magazine

“MHVillage has stepped up to the plate and invested in launching a new print magazine to offer members of the manufactured housing industry a new source of knowledge,” said Ken Rishel, of Rishel Consulting Group, who serves as one of the MHInsider’s expert columnists. “Typical of everything they do, this is a high-quality, first-class publication that is actually better than most of the now gone publications.”

The MHInsider will be published four times per year along with additional distribution at industry events. The magazine will be a companion publication to the MHInsider blog for professionals, which is updated on a daily-to-weekly basis and includes a bi-weekly email newsletter. The blog newsletter provides the latest industry news and trends directly to the inbox of MH professionals.

Additionally, readers can sign up at www.MHInsider.com to receive the MHInsider print magazine in the mail, where they also can read an electronic version of the magazine, and stay up-to-date with manufactured housing industry news via the MHInsider professional blog and social channels.

Call for MHInsider Magazine Content, Advertising

For advertising opportunities with the MHInsider magazine and blog, please contact MHInsider Account Executive Matthew O’Brian at (877) 406-0232. For editorial feedback and contributions, please contact MHInsider Managing Editor Patrick Revere at (616) 888-6994.

Manufactured home communities on MHVillage were viewed 18,676,041 times in the last year. These are folks looking for homes and becoming potential residents. We also generated

Manufactured home communities on MHVillage were viewed 18,676,041 times in the last year. These are folks looking for homes and becoming potential residents. We also generated

We update our information regularly, in most cases during the last year. All data collected and reported has been in place for no more than three years. Additionally, our reports are sold “as is”. This is because we provide the reports electronically and for download. Therefore, returns are unavailable.

We update our information regularly, in most cases during the last year. All data collected and reported has been in place for no more than three years. Additionally, our reports are sold “as is”. This is because we provide the reports electronically and for download. Therefore, returns are unavailable.

Here in the United States, 95 percent of Americans own a mobile phone of some kind. The share that owns smartphones is now 77 percent. (

Here in the United States, 95 percent of Americans own a mobile phone of some kind. The share that owns smartphones is now 77 percent. (